Current Market Environment

“History doesn't repeat itself, but it often rhymes.” – Mark Twain

In the third quarter, the familiar story of big tech’s supremacy played out once again, fueled by investors’ rush toward artificial intelligence (AI) exposed opportunities. Year-to-date, the technology and communication services sectors have contributed almost 10% of the S&P 500’s 14.8% return. Given this dominance, the Index continues to get even more top-heavy, with the top ten constituents now accounting for 39% of the S&P’s weight. Against this backdrop, many have speculated as to whether we are in an “AI bubble.” Whether or not this proves to be the case, recent behavior in the stock market as well as among AI-exposed companies has us concerned…not only for the stock market, but also the overall economy.

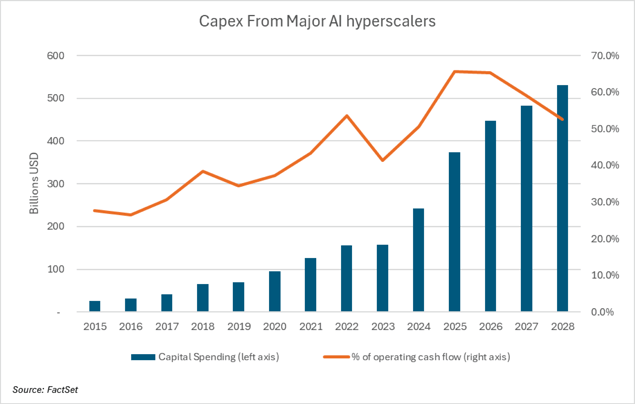

To be sure, AI will quite possibly prove to be the greatest technological advancement since the smartphone, with far-reaching societal implications. And, as with other technological advancements before it such as the inception of the railroad or the internet, billions of dollars of infrastructure will be required to accommodate the technology. Indeed, hundreds of billions of dollars are being poured into the construction of data centers with the capacity to handle the processing needs of an AI world, energy infrastructure required to power those computers, and even HVAC units to cool these data centers. However, unlike rail lines or broadband, which can last decades, the compute portion of the data center (which, according to NVIDIA’s(1) founder, Jensen Huang, can be up to half of the cost) becomes obsolete as frequently as every few years. This has (rightfully, in our view) caused some to question whether the hundreds of billions of dollars being put into AI infrastructure can possibly earn a return justifying the money being spent.

As can be seen in the chart above, the so-called hyperscalers (cloud-service providers including Alphabet(1), Amazon(1), Meta(1), Microsoft(1) and Oracle(1)) are projected to spend over $400B each of the next two years in capital expenditures after over $350B in 2025. This is a staggering amount of spending. Numbers vary, but some (including Harvard economist Jason Furman) have estimated this technology-related investment contributed over 1% to U.S. GDP growth in the first half of 2025, which would account for almost all of the 1.4% real growth during the period. In short, the U.S. economy has become increasingly reliant on the astronomical growth of artificial intelligence investment.

Also worrisome to us has been the increasingly speculative nature of the market overall. One example was the September announcement by Oracle (ORCL) that OpenAI, the parent of the large-language model chatbot, ChatGPT, signed a contract with ORCL to purchase $300B in computing power over a five-year period. Oracle (a $690B company prior to the announcement) saw its stock increase as much as 43% in that day’s trading, ultimately adding close to $250B of market value by day's end. Putting this agreement into context, it has been reported that OpenAI has yet to make money and has a current run rate of $13B in annual revenue. To say there is a lot "riding on the come" with this agreement is putting it lightly.

OpenAI followed up the Oracle deal with the announcement of a plan to purchase close to $100B of hardware from Advanced Micro Devices(1) (AMD), which sent AMD shares 24% higher on the day of the announcement. The deal also involved OpenAI’s obtaining warrants in AMD shares with a potential value also near $100B. Similarly, NVIDIA (an important supplier of artificial intelligence chips to OpenAI) announced a $100B investment in OpenAI. These, and other deals, have raised concerns about the circularity of relationships and concentration of risk in a handful of massive players in the AI infrastructure ecosystem. With the AI build-out being responsible for so much of the stock market’s recent performance, and importance to the overall economy, the interdependence of these players is disconcerting.

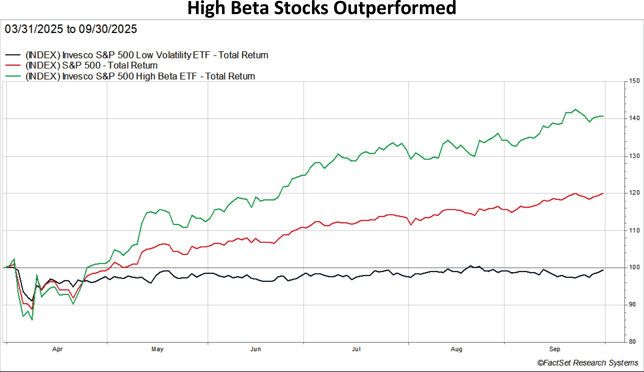

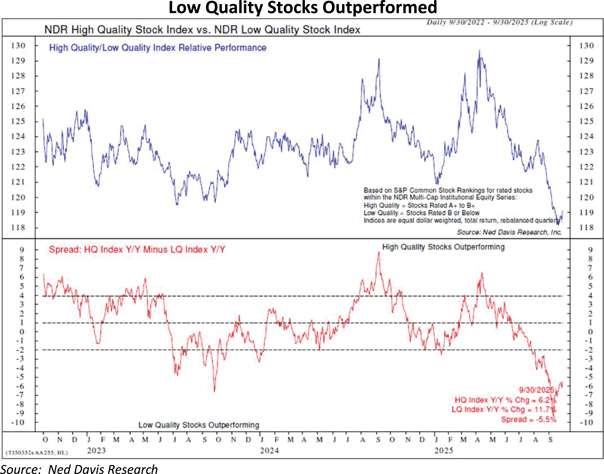

As the sharp stock reactions to the above deal announcements would indicate, a "fear of missing out" (FOMO) trade has been in full force in recent months. This has contributed to high-beta stocks (chart above) and lower-quality companies (chart below) dramatically outperforming recently. This is all reminiscent of the lead up to the “dotcom bubble,” including retail investors piling into the market, chasing the returns being seen in tech stocks. According to Morgan Stanley, retail investors bought over $100B of US equities during September alone - the largest one-month purchase on record.

Generational advancements in technology leading to investor euphoria and speculation in areas of the stock market, ever-increasing valuations, and retail investors pouring money into tech stocks…the similarities to the dotcom bubble are hard to ignore. There are major differences, however. At the turn of the century, as we saw dozens of companies going public with merely a business plan, little or no revenues, and “.com” at the end of their name, it was obvious we were in a bubble. It was also apparent that many companies would eventually become worthless when the bubble eventually popped – this despite the internet clearly being a revolutionary technological advancement. There is certainly much speculative trading in the market today, and valuations in pockets of the market appear stretched. However, rather than hundreds of unprofitable tech IPO’s flooding the market, there is a concerning concentration of money flowing into a handful of very profitable behemoths.

So, if artificial intelligence is going to change the way we live, and the data center build-out, upgrades to energy infrastructure and other costs of implementation will be massive, why is this concerning? Importantly, we would reiterate that many of the AI-exposed stocks have benefited from the expected future $1T+ of capital investment needed. Other than the fact that hundreds of billions of this promised investment has been made by OpenAI, which as mentioned above has a current $13B revenue run rate, we would point to what happened just this past January when the Chinese-developed AI model, DeepSeek, sent fears through the AI world. The announcement that DeepSeek was able to develop their model at a fraction of the cost of those like OpenAI’s ChatGPT sent tech stocks sharply lower. NVIDIA alone lost close to $600B of market cap the day of the announcement. While the recent sharp rally to new highs for many of these AI-related names would indicate the market is dubious of DeepSeek’s claims, it highlights a major potential risk. If someone can, in fact, develop AI models much more efficiently, it would greatly call into question what has been discounted in these stocks. And, given the material impact AI-related investment has already had on the overall economy, this is a risk worth contemplating.

Portfolio Implications

This has been a less-than-ideal environment for our style of investing, and your portfolio's relative returns. Lower-quality companies, higher-beta and growth stocks have been recent darlings. As you know, we favor high-quality companies within our long book and our short portfolio tends to be what we deem to be lower-quality, and more highly-levered businesses. We've been through markets like this before, and are confident the pendulum of speculation will swing back towards companies with attractive fundamentals and valuations. While we are mindful of the potential impact of artificial intelligence on current portfolio holdings as well as new ideas, we will not chase performance. The market is currently rewarding the most obvious beneficiaries of this technology, but we believe as it was with the dawn of the internet, the use cases will ultimately be far reaching with implications not as obvious initially.

Meanwhile, we continue to roll up our sleeves and find opportunities in out-of-favor sectors like consumer staples and healthcare, as well as individual bottom-up ideas in other sectors. Many solid franchises with attractive cash flows and long-term secular growth are selling at attractive valuations. For context, despite major indices showing significant gains through the first nine months of the year, over 40% of the stocks within the Russell 1000 Value Index have negative year-to-date returns through the end of September.

Within the financial services sector, we continue to favor regional banks and slowly pare back property-casualty insurance-related exposure as that sector transitions to a softer pricing environment. While regional banks have largely underperformed their mega-cap brethren (who have benefited from the robust capital markets environment), we continue to believe the regionals will benefit greatly from a more favorable regulatory environment, there will be a wave of acquisitions within the space, and fundamentals remain attractive. Other opportunities within financials include financial-tech companies who have been hit hard due to the perception that their business model is at risk from artificial intelligence, and which have underperformed partly due to the low-volatility, tight credit-spread environment within the bond market. These are highly cash-generative companies with solid long-term prospects, selling at attractive valuations.

outlook

The investor mood has shifted from fears of a tariff-induced slowdown to unbridled optimism of a Fed easing cycle, fiscal stimulus and deregulation to come. However, many uncertainties related to the global trade war remain. Meanwhile, the Federal Reserve is walking a tightrope between a weakening jobs market and inflation which is still above target and going in the wrong direction. In our view, the risk of a potential systemic shock is heightened in this environment.

We expect continued housing market pressures as a result of affordability concerns. However, the shortage of housing after over a decade of underinvestment following the Great Financial Crisis should prevent a disastrous decline in home prices. Lower-income consumers have been most impacted by the recent inflationary environment, but consumer balance sheets remain generally healthy for the majority of Americans, and consumer credit quality remains strong at the moment. We are mindful that, according to reports, much of the impact from tariffs has been absorbed by businesses to date. Future price increases in response to the import taxes could be detrimental to consumers.

What we see argues for a more inflationary and higher interest rate environment than seen in the past ten years, and risks for a recession are heightened in this uncertain environment. As always, with our bias towards quality, we strive to mitigate any downside, while also participating in the upside. Ultimately, we are optimistic the new administration in Washington will lead to less regulation and a more favorable merger & acquisition environment.

We continue to find opportunities to invest in quality businesses with solid balance sheets and cash flows, whose share prices have detached from our assessment of the fundamentals. The bargains inherent in your portfolio should attract acquirers and other investors over time.

Steadfast, we remain committed to helping you meet your financial goals while aiming to conserve your wealth.

As of 9/30/2025, the Fund’s top 10 long positions represented approximately 29% of the portfolio and included PNC Financial Se (PNC) 3.8%, Eaton Corp (ETN) 3.8%, Fairfax Financial Holdings (FRFHF) 3.4%, Globe Life Inc (GL) 3.2%, Brown & Brown (BRO) 3.0%, Abbott Labs (ABT) 2.5%, Everest Group LTD (EG) 2.5%, SouthState Bank (SSB) 2.4%, CACI International (CACI) 2.3%, and Johnson & Johnson (JNJ) 2.3%. Current and future portfolio holdings are subject to risk and change.