With Volatility Here to Stay What Should You Invest in Now?

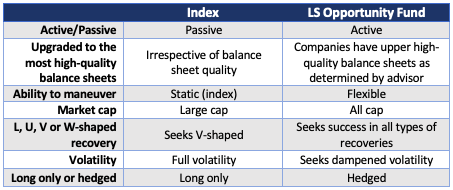

How can you help your investors take advantage of the volatility? Unfortunately, what has worked well for ten plus years, passive investing, appears to be at a disadvantage in this market environment. And while spreads have blown out in fixed income, investors need be cautious to not overload their portfolio with lower quality credit exposure.

As an alternative, do you seek a solution for a downward, sideways or upwards market? Do you seek an equity strategy with one eye toward preservation/protection and the other toward opportunity? Everyone seems to agree. There will be winners and losers from the current health and economic crisis. However, there is no consensus and no way for sure of knowing what the duration of this recession might be.

On one hand, you cannot afford to wait for you may miss the opportunities for your clients being presented at these prices. However, if you push into the most opportunistic investments too soon, your clients may not have the intestinal fortitude if the environment chooses to first get worse before getting better.

What to do? Many investors freeze and do nothing, while others panic and sell. But the most money made historically in a bear market, is not by those who do nothing, not by those who panic, and not by those who speculate too soon but rather by those who have the flexibility and experience to execute their proven crisis playbook to both preserve and capitalize.

The LS Opportunity Fund’s time-tested crisis playbook will strive to capitalize on opportunities for your clients by being nimble through active stock selection not market timing, all the while being hedged to preserve capital and dampen volatility.

Our team’s near 25 years of experience in running this strategy through all market environments leaves them ready to execute while fully taking advantage of the tools at our disposal.

All Cap, Long and Short, Opportunistic Investing/Trading

We attempt to protect and make money by being assertively flexible on your behalf. We purposely manage downside risk with an analytical, opportunistic eye toward the potential money-making investments for the current environment and eventual recovery. Each phase requires incremental and opportunistic portfolio shapeshifting to capitalize on the phases of the crisis. Buy and Hold passive investing just does not appear to cut it in this environment, or, at the very least, needs an actively managed complement to increase portfolio efficiency and return.

Crisis Playbook

"Scrub, rescrub, and scrub some more." - Portfolio Manager John Gillespie

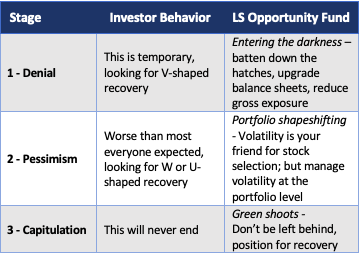

This crisis is economically unique, but investors and markets tend to react the same, regardless of the uniqueness of the crisis. So, it is the psychology of the market PLUS a solid understanding of the fundamental drivers of business you own or want to own that lead to success. The rules of engagement for each stage of any unique crisis are quite familiar to our experienced team. We execute through the stages of crisis in an effort to protect capital and maximize risk adjusted returns where others often cannot.

Stage 1 – Entering the Darkness – Complete to Near Complete

(February 19th – March 31st, 2020)

Mantra: Win by Not Losing

March 5, 2020 - "There seems to be a lot of complacency in the news. A lot of emphasis on this being a temporary blip and that everything will bounce back. Perhaps - as long as no one goes broke in the interim. But if you are a levered hotel or airline or your supply chain dried up and you are levered, well there are going to be issues." - Portfolio Manager John Gillespie

The first thing we do, and now have completed, is to batten down the hatches. We “scrub, rescrub and scrub some more” the balance sheets of the companies we are invested in. We lower gross exposure while also bringing down our net exposure a bit. Net exposure was already on the lower end of our target range (50%-70%) as we entered into this crisis.

Longs: Although our long portfolio is built on the foundation of high-quality balance sheets and always strives to be fairly recession resistant, we further upgrade the quality of our portfolio company balance sheets, seeking even stronger balance sheets and more recession resistance. Generally, this means we are trading from medium-sized to larger-sized companies with more staying power.

Shorts: Given the ferocity of the decline, we covered some of the most rewarded shorts where we felt further downside was limited. We then ask, what new short opportunities have been exposed by the characteristics of this crisis? In addition, balance sheet shorts are our specialty and cracks in credit expose great opportunities. The Federal Reserve can pump as much money as it would like into the financial system, but they cannot stop individual businesses from hitting a wall.

New Opportunities: Simultaneously, we rid the portfolio of anything even marginally questionable, while prudently harvesting losses. Companies we have long admired but were once out of reach because of valuation may have dropped into our comfort zone. A number of new positions have been initiated here.

Transition: Win by not losing - protective positioning fully in place, we have started into Stage 2. Winners and losers abound, sifting through opportunities, maximize our use of all-cap, long short flexible structure.

Stage 2 – Shapeshifting - Opportunistic Active Management – In the storm

(April 1 to Month, XX, 2020)

Shapeshifting - the ability to change portfolio composition incrementally and opportunistically with intention.

Mantra: Walking the Tight Rope

Volatility is here to stay and while volatility is the friend of the long-term investor, in the short run knows no mercy. Volatility must be capitalized on wisely and judiciously. Too much too fast and you face big mark to market losses, too little too slow and you miss opportunities and a strong rebound. This is the tight rope we walk. Passive investing is all in or all out. LSOFX is opportunistic, all cap and long short, thus having more levers to pull making this time period quite attractive.

Longs: There is a chasm between pain and relief. We walk the tight rope to get to other side. There are excellent companies, with good valuations, and strong balance sheets with juicy dividend yields, especially in staples, technology and select industrial stocks. When correlations all go to 1 as they did during the initial pull back in the market from Feb 19th to March 23rd, the proverbial baby gets thrown out with the bath water. This ultimately creates a ton of opportunity for those with multiple levers to pull, as compared to passive, allowing us to pick up the babies but leave the bath water behind.

Shorts: But no one said you had to walk the rope without a safety net and harness. The credit cycle has officially arrived. We do not really know any businesses in good shape if revenues go to zero for a period lasting more than 30 days. So, it really depends on how long our economy grinds to an almost complete stop as to what companies will be the best shorts. Be patient and then aggressive.

"We need to feel for what the tipping point will be in terms of duration and depth of this coronavirus. Is this a corona-induced air pocket or worse? And we will react accordingly." - Portfolio Manager John Gillespie

Stage 3 – Green Shoots/New Opportunities

(April 1 to Month, XX, 2020)

Green Shoots - a term used to describe signs of economic recovery or positive data during an economic downturn.

Mantra: Don’t be left behind

To capture the best opportunities, you cannot wait for the all clear. Consequently, portions of Stage 3 may and often do overlap with Stage 2. The combination of the passage of time, price and valuation levels in the market and the emergence of green shoots will cause us to purposely begin to increase gross and net exposure. At first this can be company by company and industry by industry before necessarily needing to take a full-on market exposure increase. We think once you get through the worst of this crisis, stocks could rally, and you will not want to be sitting in cash.

Longs: Being an all-cap manager, we have the flexibility to strategically rotate from the highest quality balance sheets to more opportunistic investments. Being a long/short manager, we also have the ability to increase our longs.

Shorts: Historically, our balance sheet driven approach to short investing has begun to run its course, with less bad balance sheets remaining (as those companies with bad balance sheets were wiped out or recapitalized). This is a key sign with the natural response being less shorts and a higher net exposure. Therefore, there is no need to market time, just fewer bad balance sheets left to short.

Shorts: Historically, our balance sheet driven approach to short investing has begun to run its course, with less bad balance sheets remaining (as those companies with bad balance sheets were wiped out or recapitalized). This is a key sign with the natural response being less shorts and a higher net exposure. Therefore, there is no need to market time, just fewer bad balance sheets left to short.

Purposely Overtime, Not Market Timing

We believe we are well-positioned whether the recovery is L, U, V, W-shaped. Our strategy not only has the benefit of being hedged to manage volatility – but also the benefit of having an all-cap manager who is able to be opportunistic when necessary. We believe this can be extremely beneficial in this environment and helps take the challenge away from you the advisor and the end investor as we handle the day to day value add trading/investing.

Our portfolio management team’s 25-year, proven track record through bull and bear markets gives us confidence the LS Opportunity Fund may be an excellent solution for all environments, and an exceptional solution for this one.