“Economic medicine that was previously meted out by the cupful has recently been dispensed by the barrel. These once-unthinkable dosages will almost certainly bring on unwelcome aftereffects. Their precise nature is anyone’s guess, though one likely consequence is an onslaught of inflation.” - Berkshire Hathaway’s 2008 Annual Letter

An Inflation Discussion

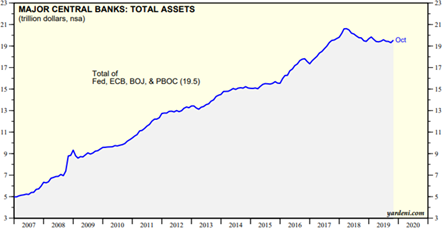

Mr. Buffett’s prediction for an “onslaught of inflation” has been a false narrative. Over a decade later, economic medicine that was once dispensed by the barrelful is now dispensed by the truckload. Since the crisis, balance sheets of major central banks have more than doubled, negative-yielding debt is now a reality to the tune of $17 trillion, and the global monetary policy rate index remains unchanged.

Central bank assets were a mere $9 trillion when Mr. Buffett made his statement:

Source: Yardeni Research

Despite a surge in stimulative measures, below-target inflation remains an issue. This is understandable given demographic trends of an aging population and low population growth, a slowing global economy, a weak manufacturing sector, Brexit uncertainty, and the trade war. Even the once hawkish Fed is concerned that the United States could be at risk of entering a period of sinking inflation, zero rates, anemic growth, and the exhaustion of accommodative monetary policy (similar to what Japan and Europe have experienced). If a progressive candidate is elected in the 2020 Presidential Election, these fears should be exacerbated as Republican tax cuts may be rolled back along with pressure on corporate profits and economic activity.

However, the United States is somewhat better positioned than peers to combat deflation going forward. We have monetary “ammunition” in the form of additional rate cuts and quantitative easing measures, while the Eurozone and Japan have few policy tools remaining. Additionally, the United States faces demographic headwinds in the form of an aging and shrinking work force as a percentage of the population – but these headwinds are less versus what Japan, South Korea, China, and parts of Europe are facing. Plus, we have relatively higher positive population growth aided by both a higher birth rate and a better immigration rate. Finally, the United States remains the premier market for business activity given robust and enforced business laws, accessible and diverse capital markets solutions, pro-business policies, and high workforce productivity.

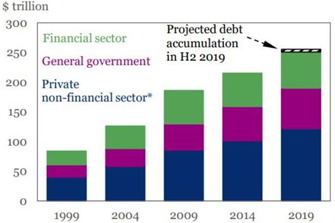

Given that policy makers are focused on fighting deflationary pressures, the outlook for a significant acceleration in inflation seems remote. However, there are multiple reasons why inflation could accelerate over time. In an effort to spur the economy, policy makers have embarked on an unprecedented campaign of quantitative easing, a tool which is inflationary in nature. Additionally, stimulative economic policy has pushed global debt to $255 trillion, which has roughly doubled since 2004. All else equal, high debt levels lead to high inflation. Another argument is governments will accelerate inflation to lower the present value of debt to facilitate de-leveraging. Finally, continued progress in trade negotiations, full employment, and a rebound in global growth may accelerate the pace of inflation.

Global debt by year:

While these arguments are rational, the reality of today’s low inflation environment is perplexing. So, is Buffett’s prediction for “an onslaught” of inflation invalid given the passage of time? Have astute policy makers undertaken a massive campaign of unconventional monetary policy with no consequences?

We don’t think so…

The transition to an inflationary environment may require an exogenous shock. The shock could come from a recession, credit crunch, escalation of the trade war, political change viewed as negative for the economy, conflict, black swan events, etc. In our view, one or more of these scenarios has a modest chance of occurring in the coming years given where we are in the economic cycle and the political climate. For example, if a recession occurs, we’d expect debt levels to meaningfully increase as automatic stabilizers such as lower tax rates, unemployment insurance, and higher use of government assistance programs such as Medicaid take hold. Fiscal spending would be used to stimulate the economy which would push debt even higher. Central banks will use what little “ammunition” is left and governments may attempt to devalue their currency in order to spur growth.

In the end, economies (perhaps our own) may be left with higher debt levels, weaker currencies, and the exhaustion of policy options. A potential result is eroding faith in the fiscal / monetary situation. Individuals might then assign a discount to our currency (i.e. require more dollars per transaction), which would be inflationary in nature. Additionally, the real cost of capital could then increase.

Assuming the inflationary pressure isn’t extreme (e.g. what the United States experienced in the 1970’s), we believe this scenario may be positive for the global economy despite the short-term pain of an exogenous event such as recession. Over the long run, the present value of debt should decline meaningfully and policy makers would gain valuable “ammunition” by hiking rates and shrinking their balance sheets to curtail inflation. This should give individuals greater faith in the underlying fiscal / monetary position – thereby improving the economic outlook and the movement of inflation to a lower and healthier level. The labor force might also benefit in the long term as businesses substitute higher cost capital for labor which will drive wage growth.

We hope the unwinding of the global debt burden and central bank balance sheets will be manageable. That said, there are bound to be casualties from such a shift. Investors heavily weighted in cash and fixed rate assets will suffer in an inflationary environment. Additionally, there will be a large swath of companies whose fundamentals and share prices would deteriorate under this environment.

Our Ready Inflation Playbook:

While we don’t expect a jump in inflation over the short / medium term, inflation can “creep-up” unexpectedly. Thus, we remain vigilant and contemplate how your portfolio should adapt to potential scenarios as they emerge. Should we enter a period of rising inflation, we would likely increase our net exposure to the following:

Companies who employ productive capital assets that produce goods and can exhibit pricing power to mitigate the cost pressure of inflation. These companies can be found in the consumer staples, technology, industrial, and energy sectors. Additionally, healthcare is an essential product and service which must be consumed. As a result, providers of healthcare should be able to pass a significant portion of costs borne by inflation to the consumer.

Companies that would benefit from a return to pre-crisis yield curve normalcy. Examples would include asset sensitive business banks, insurance companies, financial exchanges, and asset managers

Portfolio Addition – Swedish Match:

A recent addition to your portfolio is the Stockholm-based tobacco company Swedish Match AB (SWMA- SE). Given that description, one may be surprised to learn that the company has a vision for “a world without cigarettes.” Instead, Swedish Match offers quality nicotine-containing products that are recognized as safer alternatives to cigarettes, especially snus and non-tobacco nicotine pouches.

Snus is a moist, smokeless form of tobacco that is often packaged in pouches that users place in their upper lip. Due to the lack of combustion and subsequent inhalation of smoke, along with lower levels of nitrosamines (a known carcinogen), Swedish snus is considerably safer than smoking cigarettes. While not as popular in the United States, snus has a long and established history in Sweden. In fact, snus are actually more popular than cigarette smoking amongst Swedish men, and, Sweden boasts dramatically lower smoking rates than other European populations. Perhaps it is not a coincidence that Sweden also

boasts some of the lowest number of male mortalities attributable to tobacco out of that same sample group. The company believes that these products are incrementally beneficial to public health by both being safer to use than cigarettes, and by helping users quit smoking.

The market for snus is an attractive one. It is estimated that the Scandinavian snus market amounted to 430 million cans in 2018 with volumes growing +6% in both Sweden and Norway, where Swedish Match has a strong #1 market share position. On the contrary, cigarette volumes have been declining across the developed world for several years as health risks and regulatory burdens push users towards other forms of nicotine consumption.

Given the nature of the category, investing in tobacco comes with inherent risks associated with societal perception, government regulation, and of course, public & private litigation. An investor in tobacco stocks who saw the mass litigation of the mid-1990’s understands this, as does anyone following along with recent rise in teen-vaping related hospitalizations. This is why, as a tobacco-based company, it is important to take a holistic approach towards corporate-social responsibility and incorporate the needs of all stakeholders into your considerations.

For Swedish Match, this means developing their very own quality standard for Swedish snus (termed GOTHIATEK®) that goes beyond the existing international standards in ensuring their products have a high and lasting quality, along with low levels of harmful substances. Their efforts in this field have culminated in the FDA’s first ever authorization of the marketing of products through the modified risk tobacco product (MRTP) pathway for eight Swedish Match products. In plain English, the FDA, for the first time ever with any brand, concluded that using these products instead of cigarettes puts you at a lower risk of mouth cancer, heart disease, lung cancer, stroke, emphysema, and chronic bronchitis. We believe this MRTP authorization speaks to the company’s keen ability to navigate this difficult and costly regulatory environment.

Having discussed the merits of Swedish snus at length, we would be remiss not to mention the company’s newest growth driver and product that caught our attention in the first place. Zyn is a new way for users to enjoy nicotine in a smoke-free, spit-free, and tobacco-free way that we believe improves upon the existing products in the cigarette-alternative category. The all-white nicotine pouches come in a variety of strengths and flavors, and contain only pharmaceutical-grade nicotine salt and food-grade additives for flavor and texture. The product is currently available in Scandinavia, the United States, and eight additional European countries. Swedish Match has benefited from having an existing distribution footprint for its products in the United States, and they have leveraged this in order to rapidly roll out to over 60,000 stores in 2019.

Swedish Match is a well-run company with a healthy balance sheet and stable free cash flow generation. Their conservative balance sheet, with a 2.6x Net Debt/ FCF ratio vs peer average 4.6x, is further complimented by a more attractive growth profile. With the addition of Zyn, SWMA is expected to grow earnings at a 14% 3yr-CAGR through 2021, which compares favorably to their peer set who are growing at 5%. At 12/31/19, SWMA shares are valued at 17.6x 2020 estimated earnings and a FCF yield of 4.8%, which we believe is more than reasonable given their superior growth prospects.

Outlook

After a ten-year post-financial crisis period of consistent underlying conditions for equity investing, fundamentals are shifting. Modest economic growth, macro and geopolitical concerns weigh on the outlook. The upcoming Unites States presidential election is in focus, and a shift in power could lead to market volatility. Against this backdrop, however, the U.S. economy remains fundamentally healthy and continues to be a global leader.

Interest and mortgage rates continue near historically low levels, with the 10-year Treasury having retraced by over 130 basis points from the October, 2018 highs as inflation remains benign and economic growth moderates. Although we are clearly late in the economic cycle, the odds of a 2020 recession without a full-blown trade war seem low.

Investment-grade corporations have decent balance sheets and are currently producing acceptable free cash flows. We are carefully monitoring aggregate corporate debt levels (especially the BBB- debt which is a single notch above junk status), which now sit above pre-2008 crisis levels. The 2018 corporate tax cuts and the ability to repatriate foreign cash holdings should continue to drive higher employment, M&A activity, and capital returns including buybacks and dividends. Profit margins remain near all-time high levels, currently 10%, and look to be at some risk from higher wages and input costs.

In our estimation, equity valuations remain at elevated levels. In our estimation, the S&P 500 is in the tenth decile on trailing operating earnings. Equities look most reasonable when comparing earnings yields to Treasury or even high-grade corporate bond yields. In any case, the values inherent in your portfolio should attract acquirers and other investors over time. Meanwhile, we believe equities are a superior asset allocation alternative to bonds over the longer term.

Steadfast, we remain committed to our goal of making you money while protecting your wealth.

- Your Investment Team at Prospector Partners

Disclosure

Risk Statistic Definitions: Standard Deviation measures the volatility of the Fund’s returns. Beta measures the Fund’s sensitivity to market movements. Sharpe Ratio uses the Fund’s standard deviation and average excess return over the risk-free rate to determine reward per unit of risk. R-squared represents the percentage of the portfolio’s movements that can be explained by general market movements. Upside/Downside Capture Ratio measures a manager’s ability to generate an excess return above the benchmark return in up markets and retain more of the excess return in down markets. Risk statistics are relative to the HFRX. Batting Average is a statistical measure used to evaluate an investment manager’s ability to meet or beat their index. Traynor Ratio measures excess returns per each unit of market risk, as measured by beta. Sortino Ratio is a variation of the Sharpe ratio that only factors in downside risk. Omega is a relative measure of the likelihood of achieving a given return. Max Drawdown is the peak-to-trough decline during a specific recorded period of an investment. Gross Exposure is the sum of the absolute values of the fund’s long and short exposures. Net Exposure is the fund’s total long exposure less the fund’s total short exposure. The Gross Expense Ratio is 3.13%. The Net Expense Ratio is 2.91%. The Expense Cap is 1.95%. The Adviser has contractually agreed to waive or limit its fees to 1.95%.

Prospector Partners, LLC assumed investment management duties on 05-28-2015 and was formally approved by shareholders on 09-17-2015.

The Expense Cap is 1.95%. The Adviser has contractually agreed to waive or limit its fees to 1.95% and to assume other expenses of the Fund until September 30, 2020, so that the ratio of total annual operating expenses (not including interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of business, dividend expenses on short sales, expenses incurred under a Rule 12b-1 plan, acquired fund fees and expenses and expenses that the Fund incurred but did not actually pay because of an expense offset arrangement) does not exceed 1.95%.

Investment in shares of a long/short equity fund has the potential for significant risk and volatility. A short equity strategy can diminish returns in a rising market as well as having the potential for unlimited losses. These types of funds typically have a high portfolio turnover that could increase transaction costs and cause short-term capital gains to be realized.

Investment grade bonds are rated BBB or higher by S&P, and high yield bonds are rated BB or lower by S&P.

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus by calling 1.877.336.6763. The Fund is distributed by Ultimus Fund Distributors, LLC. (Member FINRA).

9464630-UFD-1/31/2020