An accommodative monetary policy does not come without costs. The most obvious being the dependency on cheap and abundant debt. Nonfinancial corporate debt as a percentage of GDP is higher today than before the financial crisis. While the credit environment is strong and we aren’t forecasting impending doom, current debt levels instill caution.

CURRENT MARKET ENVIRONMENT: A DISCUSSION OF THE DEBT SITUATION

“Debt, we’ve learned, is the match that lights the fire of every crisis. Every crisis has its own set of villains – pick your favorite: bankers, regulators, central bankers, politicians, overzealous consumers, credit rating agencies – but all require one similar ingredient to create a true crisis: too much leverage.” – Andrew Ross Sorkin

“Only when the tide goes out do you discover who has been swimming naked.” – Warren E. Buffett

CORPORATE DEBT:

An accommodative monetary policy does not come without costs. The most obvious being the dependency on cheap and abundant debt. Nonfinancial corporate debt as a percentage of GDP is higher today than before the financial crisis. While the credit environment is strong and we aren’t forecasting impending doom, current debt levels instill caution. This is especially the case given the outlook for slower economic growth coupled with the ongoing trade war and political uncertainty. We are also concerned with the higher formation of distressed debt in recent months. Today, the ratio of high yield debt trading at distressed levels has risen to nearly 10%, a sharp jump from 6% in July.

Ironically, our greatest area of concern is lower-rated investment-grade credits (i.e. BBB-rated debt). Today, the U.S. BBB bond market exceeds $3.1 trillion and accounts for fully 53% of all investment grade bonds ($7 trillion of BBB-rated debt is outstanding on a global basis). Bonds as rated by S&P. Source: WSJ

In context, there is over 5x more domestic BBB debt today versus pre-crisis levels, while non- investment grade debt has “only” doubled. Those bonds closest to the precipice of non-investment grade status, the BBB-minus issuers, comprise 27% of the BBB category, up from 23% in 2007, a dollar increase of 7x. The growth in this most vulnerable BBB-minus sector is headlined by energy, healthcare, and industrial borrowers

Interestingly, the number of BBB issuers is relatively unchanged for over a decade, indicative of the BBB cohort taking on additional leverage. That said, part of the growth is explained by the change in the composition of BBB issuers. Post financial crisis, multiple financial institutions with massive balance sheets were downgraded to BBB, although to be fair, most of these are BBB plus, three full notches above high yield. Citigroup alone explains 14% of total BBB debt growth since 2010. While some financial institutions “belong” in the BBB category, we would argue traditional banks such as Citigroup do not, as they now have enhanced regulatory oversight, better liquidity profiles, and carry significant excess capital. Additionally, high-risk lending activities have shifted from the banks to “shadow lenders” post-crisis. Alternative asset managers, credit funds, specialty finance companies, and BDCs (business development companies) originate a large portion of this risky debt and often with “covenant-lite” structures. You can rest assured that we have avoided investing in these non-traditional entities.

What does a recession look like for the BBB issuers? Post the 2001 recession, 15% of BBB issuers realized downgrades to high-yield status in the following three years. In 2008, that figure was 11%. However, in both recessions, over 40% of issuers were labeled as having the potential of being downgraded to high yield. The next recession could be more material for BBB issuers given the staggering growth of debt versus prior cycles, and the higher weighting of BBB-minus within the cohort. Not surprisingly, we’ve conservatively positioned your portfolio toward A-rated or better companies. Excluding BBB+ issuers (which must be downgraded three notches before becoming junk) and non-rated companies, only 25% of your weighted long portfolio is rated BBB or lower with a mere 3% collective exposure to non-investment grade issuers. If these BBB-minus bonds are downgraded just one notch, the issuers will be considered “high yield.” This will result in materially higher borrowing costs, increased investor scrutiny, reduced access to the credit markets, and (all else being equal) lower net earnings.

CONSUMER DEBT:

Consumer debt is also an area of concern, but to a lesser extent. Domestic consumer debt is now

$14 trillion – above levels realized prior to the financial crisis. However, real GDP has increased over 20% since then, which supports a higher debt level. Additionally, the credit profiles of consumers are stronger and subprime borrowings are at reasonable levels. While the majority of consumer debt remains in the form of secured mortgages, the composition of the remaining has changed. Auto loans have grown disproportionately, nearly doubling to $1.2 trillion since post-crisis lows. Despite recent worries, credit quality has held up and lenders have tightened their standards. Also concerning is the growth in student debt which has tripled since 2007 to $1.6 trillion. While not an immediate concern, it is a long-term problem as debt incurred today restricts future growth. In your portfolio, we have avoided consumer finance stocks given the inferior risk/reward dynamic. At this point in the cycle, we favor investing in traditional banks which carry lower risk with upside potential given a positive loan growth outlook, strong underlying credit quality, and attractive shareholder-return policies.

Another form of consumer leverage is margin debt. Today, it stands shy of $600 billion as compared to $450 billion at the start of the 2008 recession and over $400 billion at the height of the tech bubble. On a margin debt/GDP basis, we are in-line with peaks realized during the tech bubble and the year prior to the financial crisis. While margin debt/GDP has been elevated for several years, it remains an area of concern and will exacerbate market corrections as realized in the recent Q4 2018 sell-off.

U.S. GOVERNMENT DEBT:

Today, national debt/GDP is 104% as compared to 63% in 2007 and projected to represent 144% of GDP by 2049. The national debt is akin to student loans – while not an immediate concern, it could become a major problem. The higher the debt burden, the greater the servicing costs which could otherwise be used for other expenditures. To illustrate the severity, if interest rates are one percentage point higher versus projections the debt/GDP burden will reach 200% by 2049 (likewise if GDP growth undershoots projections). At this level, a combination of fiscal tightening, further debt issuance, and quantitative easing may be needed – which will likely have negative implications on the economy.

To put national debt in a global context, the United States is one of the most indebted nations in the G-20. The only countries more indebted are Japan at 236% of GDP and Italy at 132% of GDP. Going forward, investors may shift allocations to less-indebted countries such as the United Kingdom, Canada, Australia, Germany, South Korea, China and, over the long term, to emerging economies such as India, Brazil, and Indonesia. This could result in higher national borrowing costs and a slower growth rate for the United States.

A HICCUP IN THE REPO MARKET

Near the end of the third quarter, the overnight funding market (commonly referred to as the “repo market” – where banks go to obtain short-term funding) exhibited a level of instability not seen since the financial crisis. In summary, approximately $150 billion in corporate tax payments came due at the same time as U.S. Treasuries being auctioned. Consequently, there was an outflow of bank deposits from the private sector (potentially also exacerbated by withdrawals by depositors making payments for quarterly individual tax estimates). As bank deposits/reserves were depleted, the cost of funding in the repo (short for repurchase) market spiked above Fed funds on multiple occasions to as high as 9% due to the reduction in liquidity. In response, the Federal Reserve is intervening by offering a daily borrowing line which has reduced the cost of borrowing toward the desired range of Fed funds.

In the short term, the Fed has stabilized the market and this incident is being viewed as a simple “glitch.” However, we believe there is elevated risk of additional liquidity shortages going forward. One driver being the implementation of Dodd-Frank and Basel III regulations. These regulations force banks to hold large amounts of liquid assets and de-emphasize growth, causing banks to reduce lending activities. This exacerbated the recent liquidity crunch as large banks did not lend money overnight despite advantageous rates. Another risk factor is cash is in short supply since the Fed began quantitative tightening – shrinking its balance sheet by nearly 40% since 2017. As the Fed reduced its balance sheet, it also reduced the amount of cash in the banking system. Less cash in the banking system equates to a greater chance of overnight liquidity shortages.

EQUITY MARKETS / PORTFOLIO IMPLICATIONS

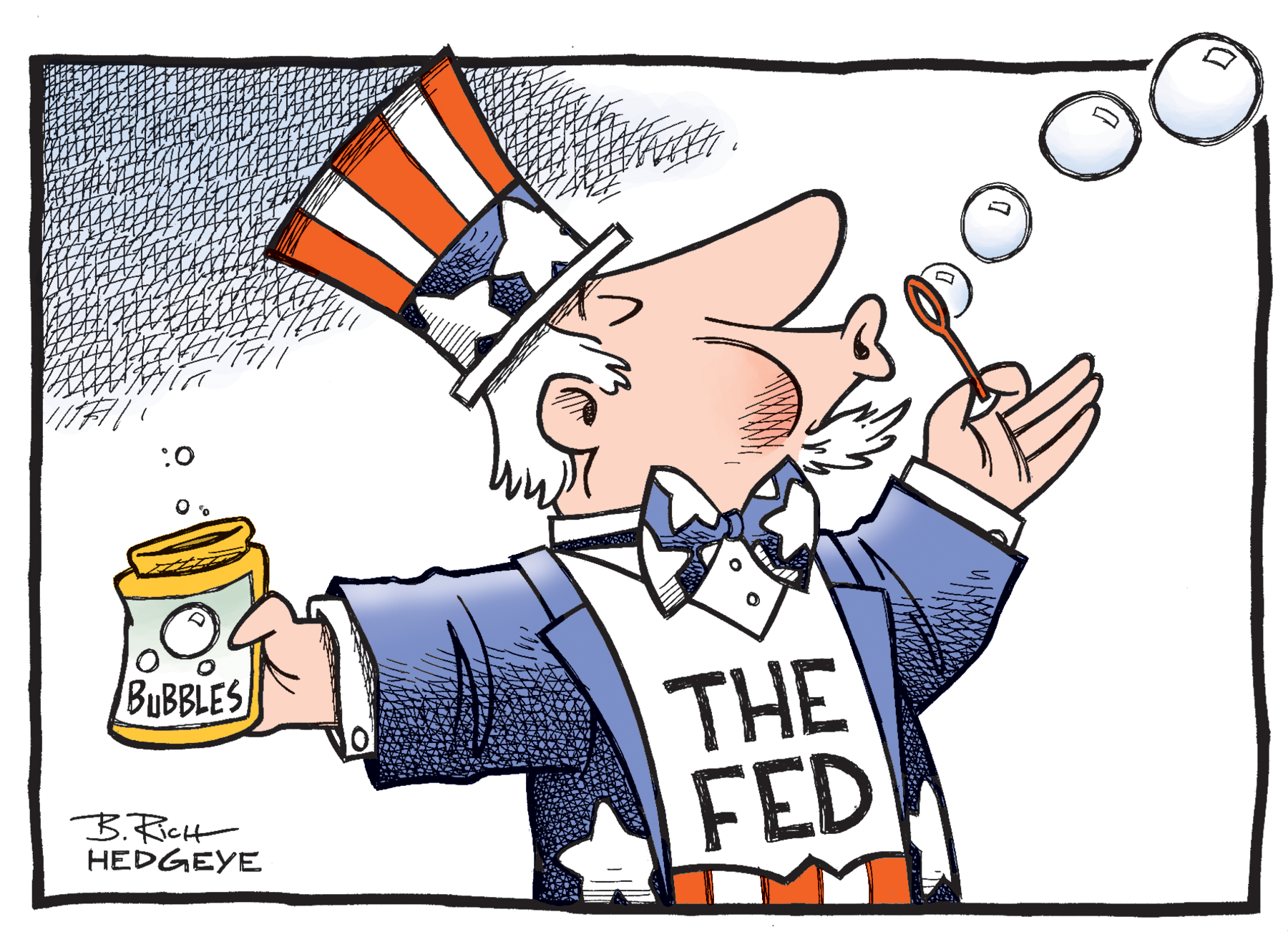

Clearly, the Fed has fueled a leveraging cycle since it began to employ its accommodative monetary policies. It’s a virtual certainty that we will go through a credit/deleveraging cycle of some form in the future. While we have little ability in predicting the cycle, we can evaluate corporate balance sheets with scrutiny. It should come as no surprise that your portfolio is largely invested in companies with conservative balance sheets that should exhibit resilience through a credit/economic cycle while exhibiting attractive earnings growth in the current environment.

Since the business cycle is not extinct, inevitably, a credit cycle will accompany an economic downturn. This will create an opportunity for us to establish short positions in lenders who are characterized by optimistic marks on their loan books, lax underwriting standards, and, as a result, thin capital levels. We will also likely find opportunities to sell short leveraged life insurers who are large holders of public debt issues.

Additionally, and specifically related to the overnight funding situation, we tend to favor banks which hold significant excess capital, have “vanilla” balance sheets, a low dependency on overnight borrowings, and small enough to be exempt from onerous regulatory requirements. While not immune, we expect your holdings to be more resilient to any potential stress in the money markets. That said, we are hopeful this liquidity issue will abate over time. The Federal Reserve will let its balance sheet expand over time which will inject cash into the system, thereby improving liquidity. Furthermore, there is momentum from the Federal Reserve and OCC behind scrapping a margin requirement rule which would free up $40 billion in capital for lending activities among other proposed reforms.

OUTLOOK

After a ten-year post-financial crisis period of consistent underlying conditions for equity investing, fundamentals are shifting. Modestly slowing economic growth and macro concerns have given investors pause and led to a rerating of certain risk assets. Regardless, the U.S. economy remains fundamentally healthy and continues to be a global leader.

Interest and mortgage rates continue near historically low levels, having retraced by over 160 basis points from the October 2018 highs as inflation remains benign and economic growth moderates. Although we are clearly late in the economic cycle, the odds of a 2020 recession without a full-blown trade war seem low.

Investment-grade corporations have decent balance sheets and are currently producing acceptable free cash flows. We are carefully monitoring aggregate corporate debt levels (especially the BBB- debt which is a single notch above junk status), which now sit above pre-2008 crisis levels. The 2018 corporate tax cuts and the ability to repatriate foreign cash holdings should continue to drive higher employment, M&A activity, and capital returns including buybacks and dividends. Profit margins remain near all-time high levels, currently 10%, and look to be at some risk from higher wages and input costs.

In our estimation, equity valuations have quickly bounced back to elevated levels. During the last four months of 2018, we moved to the seventh decile from the tenth decile on trailing operating earnings only to rebound back to the ninth decile. Equities look most reasonable when comparing earnings yields to Treasury or even high-grade corporate bond yields. In any case, the values inherent in your portfolio should attract acquirers and other investors over time. Meanwhile, we believe equities are a superior asset allocation alternative to bonds over the longer term.

Steadfast, we remain committed to our goal of making you money while protecting your wealth.

– Your Investment Team at Prospector Partners