Current Market Environment

“Don’t get caught up with what other people are doing. Being a contrarian isn’t the key but being a crowd follower isn’t either. You need to detach yourself emotionally.” - Warren Buffett

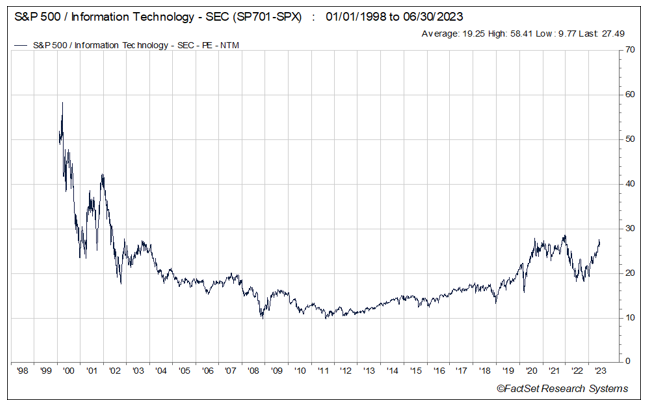

Much of the second quarter was dominated by all things artificial intelligence (AI), after a new version of OpenAI's chatbot, ChatGPT, was released in March. The sophistication and capabilities of this version of so-called "generative AI" caused an uproar within the tech world and beyond. Forecasts for the technology’s impact ran the gamut, from students using it to write papers to eliminating the need for a quarter of the workforce. Some even warned of a scenario where AI could result in the end of humanity. Meanwhile, investment flows rushed to anything "AI related," boosting shares of companies deemed to benefit the most from the burgeoning technology. For example, NVIDIA Corporation (NVDA), manufacturer of powerful computer chips used in the artificial intelligence space, returned over 52% in the second quarter alone, adding over $300 billion of market value and becoming one of only a handful of trillion-dollar market cap companies. Unsurprisingly, given the ChatGPT-induced momentum, technology stocks once again led the market higher, returning 17% in the quarter and contributing over half of the S&P 500’s return during the period. This led to yet another quarter with poor overall breadth for the market. It is tempting to compare the near frenzy surrounding AI during recent months with the hype of the “dotcom bubble” as seemingly anything AI-related rallied, much like internet-related companies at the turn of the century. While large technology stocks have reached lofty valuations, as can be seen below, we have not reached the “bubble” proportions of 2000. However, over time, as we saw following the bust of the dotcom boom, there will certainly be winners in artificial intelligence, but there will also be many, many losers. Investors should tread with (more) caution.

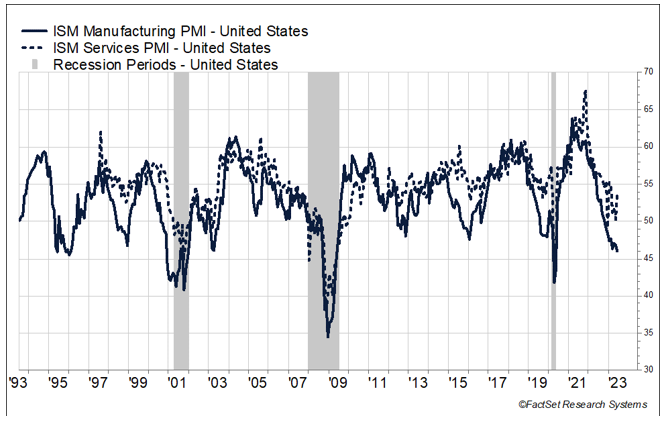

Meanwhile, despite persistent inflation, and a Federal Reserve which seems to be more hawkish by the month, market sentiment appears to be back in the “soft landing” or even “no landing” camp when it comes to the potential for an economic slowdown, quickly shaking off concerns from the March bank failures. This positive shift in sentiment contributed to a “risk-on” rally during the second quarter, where in addition to the aforementioned technology sector, consumer cyclicals within the S&P 500 also saw mid- teens gains during the period. Defensive sectors like consumer staples and utilities declined, and healthcare had only modest gains. Some have opined that we are experiencing a "rolling recession" where different parts of the economy face downturns at different points in time. This is quite possible, as we continue to deal with the myriad ramifications of a once in a lifetime pandemic. For example, manufacturing has shown contraction for eight months in a row, as the Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) has been below 50 over that period, a level representative of contraction. Conversely, the services PMI continues to show growth – albeit steadily declining.

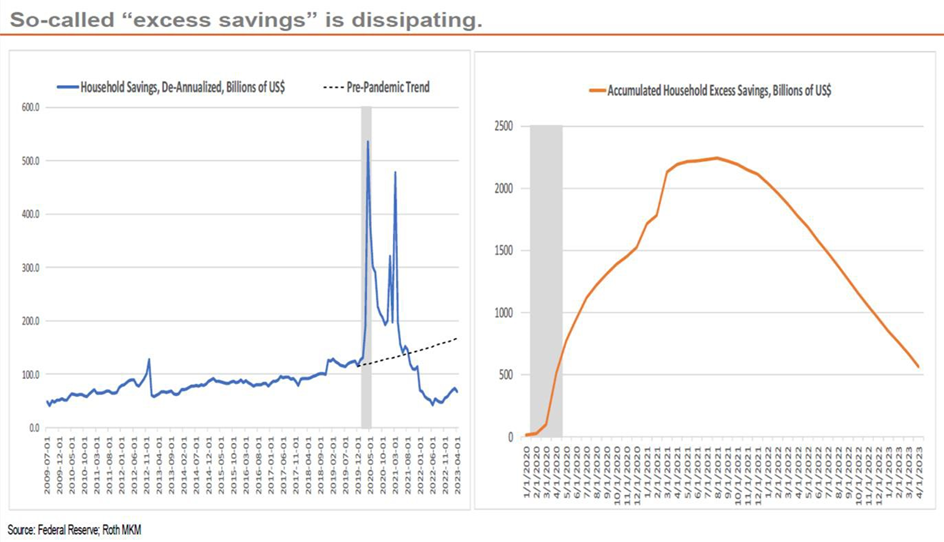

Quite possibly, this slowing in manufacturing is the result of the large swings in inventories which were stockpiled following pandemic-induced shortages and have since been depleted in recent months. Meanwhile, with pandemic quarantines and social distancing still freshly in mind, the consumer continues to spend on experiences like travel and dining out. How much of this spending is it due to "excess savings" built up from the trillions of dollars of pandemic-related stimulus is unknown (for one estimate, see the chart provided by Roth MKM below). However, consumers’ pocketbooks are no doubt getting lighter as we distance ourselves from the unprecedented stimulus. Additionally, the full impact of over 500 basis points of Federal Reserve tightening in just over a year takes time to work its way through the economy. Currently, adjustable rate mortgages are resetting at much higher rates, and corporations are faced with financing capital expenditures or refinancing maturing debt at significantly higher interest rates, and with less available credit as banks tighten standards. This will increasingly stress cash flows, and is already being felt by businesses. As the Wall Street Journal recently pointed out (quoting data from S&P Market Intelligence), bankruptcy filings through May, at 286, are the highest since 2010 for the same period.

Despite these causes for concern, the debt and equity markets seem to have a "nothing to see here" attitude. As mentioned above, the stock market has been driven by "risk on" sectors and stocks, with cyclically-exposed companies and sectors driving returns year to date. Additionally, as can be seen in the chart below, high-yield spreads in the bond market continue to be extremely tight and not indicative of a looming recession.

Portfolio Positioning

In this uncertain environment, we are content maintaining our quality bias, and are not inclined to “chase performance” by, for example, loading up on AI-related holdings. We feel Mr. Buffett’s quote above is fitting in the current environment. The relative narrowness of the market’s recent advance has continued to offer opportunities to buy quality companies, in both cyclical and defensive industries, at attractive valuations. We have also continued to add / increase short positions with weaker balance sheets, and exposure to a potential pullback by consumers – especially the lower-income consumer, who benefited the most from stimulus, and should most feel the impacts of those funds drying up. At our core, Prospector portfolio managers and analysts are bottom-up stock investors, while at the same time being thoughtful about the macro environment. With that in mind, as of June 30, the portfolio continues to maintain a relatively balanced weighting towards companies that are both cyclically exposed and defensive in nature and the Fund’s net long exposure of about 61% is about in line with historic levels. Our bank weighting continues to be low relative to history. This exposure will likely increase as we move beyond and/or get more clarity into today’s challenges, including deposit attrition and the potential for credit deterioration. Eventually, we believe the sector will see significantly higher merger and acquisition activity. We also continue to maintain overweight exposure to property-casualty related names, who continue to benefit from increased pricing and sell for reasonable valuations. The Fund also continues to be significantly underweight technology and communication services. While these stocks have once again been in vogue (as mentioned above), we are finding more attractive risk / reward in other cyclically- exposed sectors.

Outlook

Over the last 16 months, the Federal Reserve has aggressively raised interest rates in an effort to lower inflation, causing significant uncertainty within stock and bond markets. Markets seem likely to remain volatile until interest rate increases are behind us, and the resulting impact on the economy is more foreseeable. The U.S. and rest of the world continue to manage the impacts of high inflation, geopolitical events, China’s rotation from a “zero-COVID” policy, and stresses within the banking system. In our assessment, the probability of Federal Reserve policy error and / or recession has increased.

Employment remains strong. Supply / demand imbalances in the labor market suggest further wage gains, which partially mitigates the impact of inflation on the consumer. We expect continued pressure on housing prices as a result of higher interest rates and affordability concerns. However, the shortage of housing after over a decade of underinvestment following the Great Financial Crisis should prevent a disastrous decline in home prices. Lower-income consumers have been most impacted by the current inflationary environment, but consumer balance sheets remain generally healthy for the majority of Americans, and consumer credit quality remains strong at the moment. COVID-related headwinds continue to dissipate. These are reasons to believe a recession could be less significant than the previous two recessionary periods.

Following years of lower interest rates helping to drive ever-higher growth-stock valuations, we feel value investing is ripe for a period of outperformance. We continue to find opportunities to invest in quality businesses with solid balance sheets and cash flows, whose share prices have detached from our assessment of the fundamentals. The bargains inherent in the portfolio should attract acquirers and other investors over time.

Steadfast, we remain committed to making you money while aiming to protect your wealth.

Disclaimer:

The information presented should not be considered a recommendation to purchase or sell any particular security. There can be no assurance that any securities identified herein will remain in the Fund’s portfolio or, if sold, will not be repurchased. The securities identified do not represent the Fund’s entire portfolio and in the aggregate may represent only a small percentage of the Fund’s portfolio holdings. It should not be assumed that any of the holdings identified have been or will be profitable, or that recommendations made in the future will be profitable.

Past performance is not a guarantee of future results.

Important Risk Information

Investment in shares of a long/short equity fund have the potential for significant risk and volatility. A short equity strategy can diminish returns in a rising market as well as having the potential for unlimited losses. These types of funds typically have a high portfolio turnover that could increase transaction costs and cause short-term capital gains to be realized. The stocks in the Fund’s portfolio may decline in value or not increase in value when the stock market in general is increasing or decreasing in value and you could lose money. The Fund may lose money due to fluctuations within the stock market which may be unrelated to individual issuers and could not have been predicted. The price of the securities which the Fund holds may change unpredictably and due to local, regional, international, or global events. In the case of a general market downturn, multiple asset classes, or the entire market, may be negatively affected for an extended and unknown amount of time.

Risk Statistic Definitions:

Standard Deviation measures the volatility of the Fund’s returns.

Prospector Partners, LLC assumed investment management duties on 05-28-2015 and was formally approved by shareholders on 09-17-2015.

Morningstar US Long Short Fund Category – Long-short portfolios hold sizable stakes in both long and short positions. Some funds that fall into this category are market neutral – dividing their exposure equally between long and short positions in an attempt to earn a modest return that is not tied to the market’s fortunes. Other positions that are not market neutral will shift their exposure to long and short positions depending upon their macro outlook or the opportunities they uncover through bottom-up research.

The Fund is distributed by Ultimus Fund Distributors, LLC. (Member FINRA).

17194552-UFD-08/01/2023