Insights from Prospector Partners, Sub Advisor to the LS Opportunity Fund.

At Prospector, when we evaluate a company our first objective is to assess its downside risk. We do this by looking at the balance sheet first, followed by the cash flow statement, and finally the income statement. This is the inverse of how most equity analysts approach fundamental analysis and how management teams typically discuss their financials on quarterly earnings calls. The income statement is of the least importance to us simply because it’s the easiest financial statement to manipulate and, for a variety of reasons, company executives do not hesitate to make substantial adjustments to their earnings in order to paint the rosiest possible picture for investors.

“When we evaluate a company our first objective is to assess its downside risk. We do this by looking at the balance sheet first, followed by the cash flow statement, and finally the income statement.”

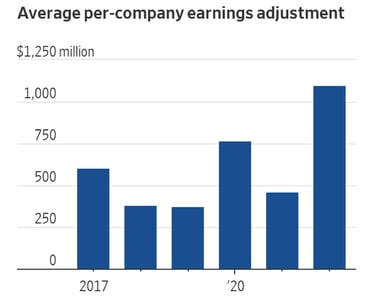

Record Level of Earnings Adjustments in 2022

A recent study conducted by research firm Calcbench, which looked at the earnings from 200 S&P 500 companies in 2022, revealed that on average, non-GAAP net income exceeded the corresponding GAAP figure by $1.1 billion. The adjustments represented an impressive 38% of GAAP net income, up from 14% in 2021. Of the companies that reported non-GAAP earnings, 83% adjusted their net income upward.

Non-GAAP Earnings: An Unreliable Indicator of Company Health

Now faced with increasing scrutiny from the SEC, management teams argue that adjusted earnings figures represent the performance of their company’s “core” operations, helping investors differentiate the impact of one-off events from the performance of the underlying business. While this is true to an extent, companies have become dependent on these tactics in order to shine a positive light on their business. We think prudent investors should avoid relying too heavily on non-GAAP earnings as a measure of company health.

Source: Calcbench

Academic studies have indicated that adjustments to the income statement are more frequent and larger when economic conditions are deteriorating. It’s also notable that executive compensation packages are commonly determined by non-GAAP financial measures. In a 2022 publication from MIT’s Robert Pozen, it was shown that firms reporting the largest difference between GAAP and adjusted earnings awarded higher pay packages to their CEOs and were more likely to beat the earnings targets specified in their compensation plans.

“Academic studies have indicated that adjustments to the income statement are more frequent and larger when economic conditions are deteriorating.”

Alas, the obvious conflicts of interest surrounding income statement adjustments do not prevent many investors from basing their investment decisions around simplistic metrics like the P/E ratio, which we pay relatively less attention to. Deep fundamental analysis remains at the heart of our practice, and that means rolling up our sleeves to identify companies with resilient balance sheets, strong free cash flow generation, and management teams that act in the best interest of their shareholders. Our approach to equity analysis, which resembles the way fixed income analysts approach credit investing, involves scrupulous financial modeling, regulatory and statutory financial statement decomposition, and direct conversations with the company. We believe our steadfast focus on downside risk mitigation will continue to produce superior risk-adjusted returns across market cycles.

Source: Prospector Partners

17095985-UFD-07052023