Don’t Poke the Bear...

Some investors are wondering: Is now the time to rebalance my portfolio? Is the worst behind us or ahead of us?

While we cannot be certain about the future, we can be certain about the past. The average bear market, which is when the S&P 500 is at least 20% below its high, has lasted 289 days, according to Hartford Funds. What this means is that it could be a while before the broader market generates strong returns for passive investors. Stock prices are reflective of future company performance. Economic headwinds such as inflation, tightening monetary policy, and slowing growth are unlikely to fuel a turnaround in future expectations of profits anytime soon.

With that being said, the decline could partly be due to investors anticipating the end of our current debt cycle. The debt cycle is the cycle characterized by increased borrowing that leads to higher interest expenses and eventual default for some. The most recent debt cycle ended in ’08, contributing to the bankruptcy of companies like General Motors and Lehman Brothers. While the general credit quality of borrowers today is vastly different than it was leading up to ’08, our rising rate environment is similar. Debt grew increasingly expensive from ’05-’07, potentially contributing to deteriorating balance sheets and the Great Financial Crisis. Today, we are beginning to enter a rate hike cycle and investors are already pricing in poor earnings quality into valuations. The more expensive it is to finance debt, the harder it may be to generate profits, potentially leading to further declines in the value of overleveraged companies.

embrace the bear

A Long short strategy is well positioned to benefit in this environment. Strong companies are positioned to disproportionately benefit from the end of a debt cycle from their ability to make cheap acquisitions and return profits to shareholders in the form of buybacks and increased dividends, both a rarity during contractions. On the other hand, companies unprepared for a tightening credit market could face bankruptcies or forced asset sales, causing investors to flee. A long short strategy allows investors to generate profits on both sides of the market. This in turn naturally provides an element of risk mitigation potentially allowing for capital preservation during market-wide selloffs, such as ours.

For example, the HFR Equity Hedge Index that measures long short performance gained 1.6% during the Dot com bubble from ’00-02. The S&P 500 declined an average of 15.5% annually during the same period. The demonstrates the downside protection a short position may have in a portfolio. Long short funds have historically fared relatively well compared to the S&P 500 during steep market drops. This makes wealth preservation a hallmark of a long short strategy, providing investors with comfort during periods of stock market declines.

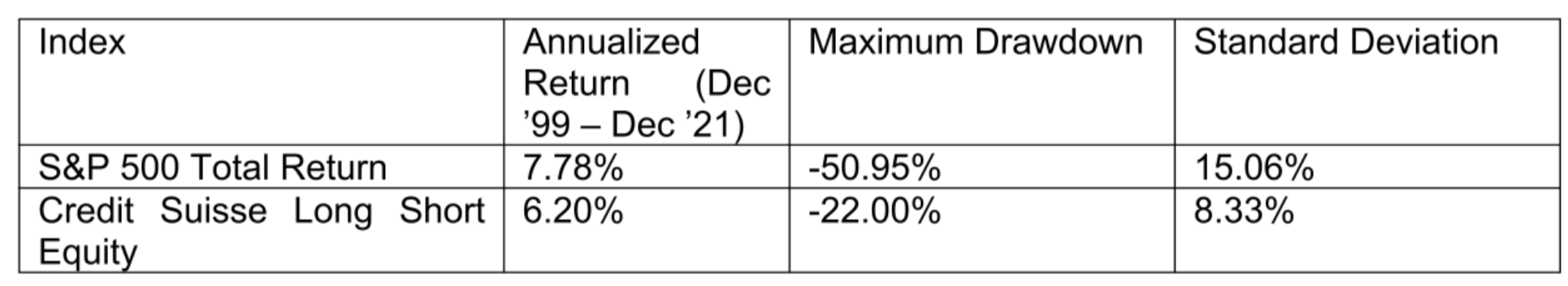

Figure 1: Return, Maximum Drawdown, and Beta of Different Strategies

Source: Credit Suisse

Figure 1 illustrates the eye-catching risk-mitigation effect a long short strategy has historically had over the last two decades. The return foregone to achieve the reduced volatility is negligible. Long short not only has a low correlation to our increasingly volatile market, but also has a proven track record of solid returns.

To learn more about how a long short investing strategy can fit into your portfolio, click here to schedule a call.

15277147-UFD-07/06/2022