Current Market Environment

We find ourselves questioning the maxim, “Good things come to those who wait.” After waiting years for interest rates to rise, thereby ushering in a value stock renaissance, “Be careful what you wish for.” is perhaps a more appropriate sentiment. Indeed, while interest rates continued to rise in the second quarter, and value stocks outperformed, this came in the midst of a stock market selloff, which saw the benchmark S&P 500 enter bear-market territory in June. The 10-year Treasury yield, which ended 1Q22 at 2.34%, rose to a peak of 3.48% during the second quarter as inflation blew past expectations. Perhaps most concerning, food and energy prices continued to march higher, pinching consumers’ pocketbooks and causing increased fears of a pullback and resulting recession. Meanwhile, the Federal Reserve remains in a predicament, aggressively raising interest rates, while attempting not to cause too drastic a slowdown in the economy. At the same time, they are surely taking note of many key commodities rolling over. For example, as of July 15th, oil is 25% off 2022 highs, lumber 56%, wheat 43%, corn 27%, copper 37%, etc. While these decreases have yet to work their way into lower prices for consumers, eventually they should, and the Fed risks being overly hawkish and sending the economy into a severe downturn.

Meanwhile, the U.S. may already be in a recession. Real GDP declined 1.6% in the first quarter, consumer confidence is plunging as gas prices hit record highs, and retail sales fell 0.3% in May for the first time this year, falling short of consensus expectations for +0.1%. Recession or not, it is likely semantics – the economy is slowing. However, much as we were of the opinion last year that the stock market and Federal Reserve were underestimating prospects for inflation, we believe many of the draconian scenarios being discussed are likely overshooting the mark. Many believe that in order to tame inflation the Fed will need to continue aggressively hiking rates in 50 to 75 basis point increments for the next several meetings, and thus sending the economy into a severe recession. By way of reference, estimates in mid-June had the Fed Funds Rate reaching a high of 3.75% by April, 2023, compared to 1.58% currently. And, while current expectations have been reduced to a high of 3.50%, we believe this to be overly aggressive, as the already- slowing economy is doing some of the Fed’s work for it. As mentioned above, many commodities are well off peak levels, and gas prices have started to decrease. Additionally, supply chains are beginning to normalize, which will alleviate some of the resultant cost pressures. Notably, inflation expectations have also come in recently, as can be seen by the 5-year TIPS breakeven chart below.

In our estimation, the Fed will be less aggressive than current forecasts would indicate, and while we may experience a moderate recession, many stocks are already discounting that (or worse). As discussed further below, we see attractive opportunities in several cyclical areas, including (but not limited to) certain restaurants and banks.

Opportunity in Banks

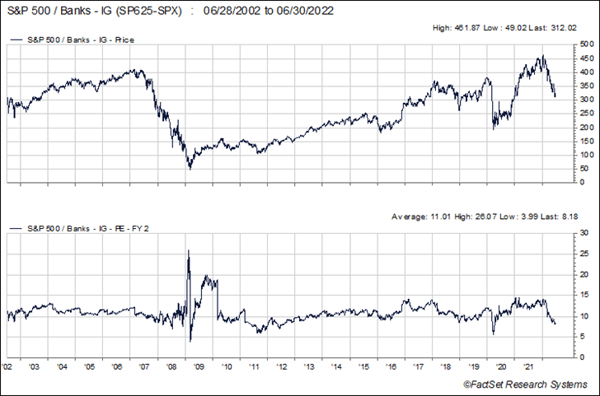

We believe the bank sector offers an asymmetric risk-reward opportunity. Despite taking our sector exposure materially lower after strong price performance in 2021, we nonetheless remain overweight. Bank valuations today are attractive, currently in the bottom decile on forward price-to-earnings at 11x and bottom quartile on price-to-tangible-book-value at 1.6x. It is worth noting that forward estimates reflect a normalization of credit quality toward pre-COVID levels. At this point, investors are discounting a moderate recession in valuations, and investor sentiment is unsurprisingly poor. Given banks are dependent on consumer and business credit quality, on the surface it is understandable why investors have flocked from the sector. However, we are significantly more constructive on fundamentals.

Post the Great Financial Crisis, balance sheets have drastically improved which offers significant downside protection in the event that a recession takes place. Loan underwriting standards are very strong relative to long-term history, securities portfolios carry minimal risk, lenders are awash in liquidity, and banks maintain excess regulatory capital. While the introduction of Dodd-Frank and other regulatory burdens following the Financial Crisis have been a headache for banks, they have undoubtedly strengthened risk controls and oversight. It is also worth noting that while investors believe a major deterioration in credit quality is around the corner, credit quality and delinquency trends remain quite good.

Additionally, investors are overlooking the upside case for owning banks via earnings leverage to higher short and long-term interest rates. This can alternatively be viewed as an embedded hedge against the persistence of above-trend inflation. The loan growth outlook also remains strong for the sector, and many banks in the LS Opportunity Fund’s (the “Fund”) portfolio that we regularly meet with cite record loan pipelines. Compared to other sectors, banks remain shareholder friendly when it comes to capital return policies with regular stock buyback programs and attractive dividend yields. We also expect the bank consolidation trend to continue with multiple names in the Fund’s portfolio as potential beneficiaries. In summary, we like owning banks at heavily discounted valuations with an embedded call option on higher rates and a less than severe economic downturn.

Restaurants

Restaurants are another cyclical area in which we see opportunity. As many have witnessed, restaurants were severely impacted by the pandemic-induced lockdowns of the past few years, with full service restaurants the most severely affected given their reliance on in-person dining. To help withstand the difficult environment, restaurants leaned into off-premise sales channels such as curbside and 3rd party delivery, menus were simplified to reduce food waste, and companies found more efficient ways to staff restaurants and run corporate operations. Eventually, COVID-19 vaccines were administered to the population, and legislators began easing the restrictions on in-person dining. Many restaurant stocks reached all-time highs as investors extrapolated the new, leaner, cost structures of these companies onto a sales environment of pent-up demand and looser restrictions. However, that optimism would prove to be short lived.

Over the past 18 months, restaurants have faced a variety of issues which negatively impacted company fundamentals, investor sentiment, and ultimately, stock prices. Staffing has been a challenge, with companies struggling to recruit and train employees in a tight labor market, especially as various waves of COVID drove increased absenteeism and reductions in the workforce. Restaurants were forced to either increase their wages or fail to service demand. Company margins were further pressured by increasingly elevated food procurement costs. Combined, these cost buckets have a major impact on overall restaurant profitability, with food & beverage plus labor costs typically accounting for 60% of a restaurant’s revenue. As a result of these pressures, the prospect of ever-expanding margins were deemed too optimistic and investors reduced their outlook for the restaurant industry’s prospective earnings power.

Fast forward to mid-year 2022, and investor concern has shifted from margins to consumer demand. Cost inflation across a wide range of essential products and services has led to declining consumer sentiment and a lower level of discretionary funds available. Additionally, the Federal Reserve is tightening financial conditions to slow economic activity and fight inflation. Slowing economic activity and more cautious consumer spending habits are not typically favorable for discretionary activities like dining out. Given this backdrop, restaurants stocks have sold off considerably. Earnings estimates for the broader S&P 1500 Restaurants index have fallen >7% this year to reflect cost inflation across both food and labor, and a weakening demand environment. The index price is down 21% year to date, as the broader market environment has reduced the multiples investors are willing to pay for a given level of earnings.

Our preference for “quality” or strong businesses with best-in-class management teams is only heightened during times of volatility or economic stress. With earnings estimates for the group revised lower and investor sentiment largely negative, we saw an opportunity to increase our exposure and purchase shares of Texas Roadhouse (TXRH). Texas Roadhouse is a chain of over 670 steakhouses offering hand-cut steaks and other barbeque-oriented food at a moderate price, in a fun, family-friendly atmosphere. While TXRH is not immune to the challenges facing the industry, we believe the company’s top-tier margin profile, pristine balance sheet, long-term oriented corporate culture, and track record of industry outperformance positions TXRH favorably for the long term. Management has outlined various levers at their disposal to mitigate the various headwinds facing their business. The company currently offers an average check that is several dollars cheaper than their closest competitors, leaving room to increase prices as needed, while also implementing new digital technologies that should improve hourly labor efficiency across their restaurants. In the event of a more benign operating backdrop, we believe the company has the opportunity to capitalize on a long unit growth runway while still generating significant sums of free cash flow. To summarize, TXRH is a best-in-class restaurant operator and the current market environment presented us with an opportunity to invest with a favorable risk-to-reward profile.

Not-So-Safe Havens?

As an offset to these long opportunities, we have added shorts, or reduced exposure to names we see as inordinately exposed to the lower-end consumer, who will likely be hurt the most from the current inflation-induced slowdown. We are also leery of areas like consumer staples, where investors appear to be “hiding” given recession fears. Two recent initiations of short positions, Dollar Tree (DLTR) and Dollar General (DG) exemplify both of these themes. These companies sell a variety of merchandise at discounted prices (typically <$10) and primarily serve customers with low or fixed incomes. These two stocks have significantly outperformed their peers this year, increasing 11% and 4% respectively compared to the S&P Composite 1500 Retailing index that is down over 32% YTD. In times of market and macroeconomic stress, it is common for investors to flock to safer and more defensive industries such as consumer staples, whose results are less impacted by the cyclical gyrations of the broader economy. More specifically, there is a belief among investors that discount retailers, such as DLTR and DG, will see an influx of new customers as shoppers are squeezed by inflation and are forced to trade down away from traditional grocers and retailers. We believe these stocks are discounting this benefit, and then some. Additionally, as these companies work to offset their own cost inflation (product costs, logistics, labor, etc.), we believe they may have a hard time passing on price increases to their lower-income customers. In the event The Federal Reserve successfully executes its “soft landing” and we avoid a recession, we believe investors would abandon these so called “safety stocks” and move on to more cyclical industries.

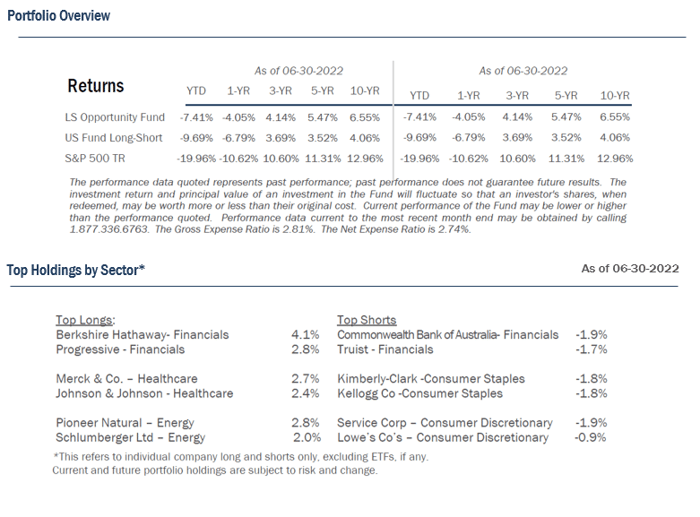

Investment Objective

The Fund seeks to achieve capital appreciation through a concentrated portfolio of long and short equity positions. The Fund’s long portfolio also holds significant positions in stable, recession-resistant companies. Moreover, the consistently generated free cash flows make these companies attractive merger partners. The key principles that guide the investment philosophy are protection of the downside and value orientation. The Fund’s portfolio is constructed with these principles in mind.

Outlook

Equity and bond market declines have been pronounced, and we are only half way through 2022. The Federal Reserve has started its aggressive campaign to lower inflation, and equity and bond markets are likely to remain volatile until investors can adequately discount the degree and duration of interest rate increases. The U.S. and rest of the world continue to manage the impacts of high inflation, Russia’s invasion of Ukraine, and China’s “zero-COVID” policy. In our assessment, markets reflect a reasonably high probability of recession.

Employment remains a bright spot in this economy. Supply/demand imbalances in the labor market bode well for the health of the consumer given full employment and the prospect for further wage gains, which partially mitigates the impact of inflation on the consumer. While there are rising concerns regarding affordability, the housing market should be buttressed by a shortage of affordable housing after over a decade of underinvestment post the Financial Crisis. Lower-income consumers have been most impacted by the current inflationary environment, but consumer balance sheets remain generally healthy for the majority of Americans. COVID mortality has improved and related pent-up demand is impacting many areas of the economy. These are reasons to believe a recession could be less significant than the previous two recessionary periods.

Following years of lower interest rates helping to drive ever-higher growth-stock valuations, we feel value investing is ripe for a period of outperformance. Further, given the recent market correction, we are finding opportunities to invest in quality businesses with solid balance sheets and cash flows, whose share prices have detached from our assessment of the fundamentals. The bargains inherent in the Fund’s portfolio should attract acquirers and other investors over time.

Steadfast, we remain committed to making you money while aiming to protect your wealth.

Disclosures:

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus by calling 1.877.336.6763.

Past performance is not a guarantee of future results.

Important Risk Information

Investment in shares of a long/short equity fund have the potential for significant risk and volatility. A short equity strategy can diminish returns in a rising market as well as having the potential for unlimited losses. These types of funds typically have a high portfolio turnover that could increase transaction costs and cause short-term capital gains to be realized. The stocks in the Fund’s portfolio may decline in value or not increase in value when the stock market in general is increasing or decreasing in value and you could lose money. The Fund may lose money due to fluctuations within the stock market which may be unrelated to individual issuers and could not have been predicted. The price of the securities which the Fund holds may change unpredictably and due to local, regional, international, or global events. In the case of a general market downturn, multiple asset classes, or the entire market, may be negatively affected for an extended and unknown amount of time.

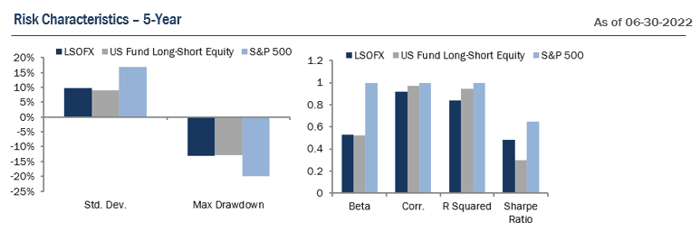

Risk Statistic Definitions:

Standard Deviation measures the volatility of the Fund’s returns. Beta measures the Fund’s sensitivity to market movements. Sharpe Ratio uses the Fund’s standard deviation and average excess return over the risk-free rate to determine reward per unit of risk. R-squared represents the percentage of the portfolio’s movements that can be explained by general market movements. Upside/Downside Capture Ratio measures a manager’s ability to generate an excess return above the benchmark return in up markets and retain more of the excess return in down markets. Risk statistics are relative to the S&P 500. Batting Average is a statistical measure used to evaluate an investment manager’s ability to meet or beat their index. Omega is a relative measure of the likelihood of achieving a given return. Max Drawdown is the peak-to-trough decline during a specific recorded period of an investment. Gross Exposure is the sum of the absolute values of the fund’s long and short exposures. Net Exposure is the fund’s total long exposure less the fund’s total short exposure. The Expense Ratio, Gross of Any Fee Waivers or Expense Reimbursements, is 2.81%. The Expense Ratio, Net of Fee Waivers and Expense Reimbursements (contractual through 9/30/2022), is 2.74%. The Expense Cap is 1.95. The Adviser has contractually agreed to waive or limit its fees to 1.95% and to assume other expenses of the Fund until September 30, 2022, so that the ratio of total annual operating expenses (not including interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of business, dividend expenses on short sales, expenses incurred under a Rule 12b-1 plan, acquired fund fees and expenses and expenses that the Fund incurred but did not actually pay because of an expense offset arrangement) does not exceed 1.95%.

Prospector Partners, LLC assumed investment management duties on 05-28-2015 and was formally approved by shareholders on 09-17-2015.

Morningstar US Long Short Fund Category – Long-short portfolios hold sizable stakes in both long and short positions. Some funds that fall into this category are market neutral – dividing their exposure equally between long and short positions in an attempt to earn a modest return that is not tied to the market’s fortunes. Other positions that are not market neutral will shift their exposure to long and short positions depending upon their macro outlook or the opportunities they uncover through bottom-up research.

†† The Morningstar Rating for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance The top 10% of products in each product category received 5 stars, the next 22 5% receive 4 stars, the next 35% receive 3 stars, the next 22 5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. Across the US Long Short Equity category, as of 06/30/2022, LSOFX received the following Morningstar Rating™ for the 3-year, 5-year, 10-year periods, respectively: 3 stars out of 178 funds, 4 stars out of 158 funds, and 4 stars out of 58 funds.

The Fund is distributed by Ultimus Fund Distributors, LLC. (Member FINRA).

15376835-UFD-07/27/2022