THE RISKS OF A LONG-ONLY PORTFOLIO

Many leading economic indicators are flashing warning signs for investors. As such, investors have been selling equity stakes since the beginning of the year.

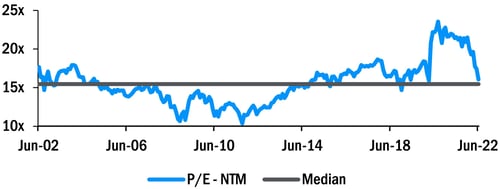

Figure 1: S&P 500 Forward Price to Earnings

Source: Factset

Figure 1 illustrates the aggregate price to earnings ratio of the S&P 500 over the last 20 years. After the steep decline, the price to earnings ratio is approaching the median. The fall in this ratio started in the beginning of the year as investors began to foresee several economic headwinds. These beliefs have been vindicated as recent economic data have been discouraging. The consumer price index grew 8.6% in May over the prior year, surpassing expectations and contributing to fears of an uncontrollable rise in prices.

This has caused investors to expect the Fed to act more aggressively in taming inflation with accelerated monetary tightening policies. The University of Michigan’s consumer confidence index has reached a record low. These trends are causing widespread fears of the return of stagflation, where the economy experiences high inflation and stalled economic growth. If the stagflation of the 1970’s is any indication of what is to come, investors may be in for a wild ride. The combination of all these factors, among others could potentially dent corporate earnings, hurting the stock market’s appeal. At the same time, bonds are declining as investors anticipate further interest rate hikes.

HOW TO WEATHER THE STORM

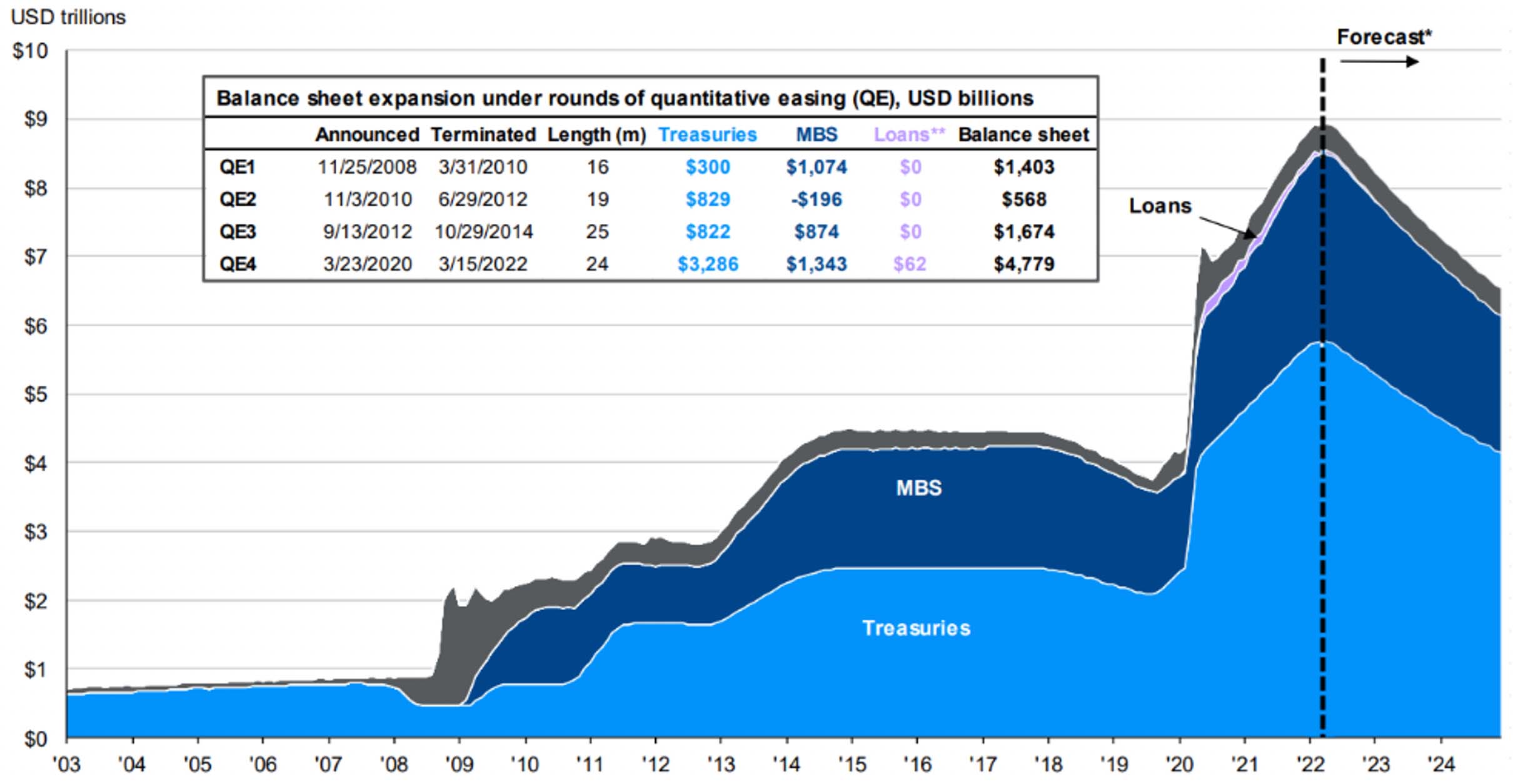

The conditions that fueled the bull market of the last decade are dissipating. The Fed has reversed its relaxed posture on monetary policy (see Figure 2), borrowing costs are rising, consumers face levels of inflation they have not seen in decades, and equities are no longer the only game in town.

Figure 2: Fed Balance Sheet

Source: J.P. Morgan

These trends point to the potential for volatility many investors are not used to dealing with. However, with a long short allocation, investors have the potential to reduce exposure to the to the broader equity and bond market, while still achieving solid returns. The economic picture has investors believing all stocks cannot continue to go up, signaling the emergence of a stock picker’s environment. Investing in undervalued companies with strong fundamentals and shorting weak companies surviving on cheap debt will allow investors to shrug off poor economic data. A value-based investing strategy has provided shelter from the economic challenges thus far as the Russell Value Index has outperformed the Russell growth Index by about 15% year-to-date.

To learn more about how to potentially weather the storm, click here.

15277147-UFD-07/06/2022