BREAKING DOWN HEDGE FUNDS

The term hedge fund carries a plethora of connotations, some good and some bad. On one hand, notable hedge funds have pioneered investing strategies, producing a stellar record of returns for their investors.

On the other hand, their immense market power can create swings in stocks that can catch the little guys off guard. Preconceptions aside, hedge funds play a central role in the world of finance. Alfred Winslow Jones is widely credited with starting the first hedge fund in 1949. His strategy involved buying stocks and hedging his positions with short sales. This traditional hedge fund strategy is centered around consistent returns and low volatility.

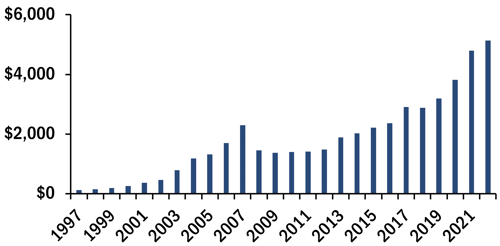

Figure 1: Hedge Fund Total Assets Under Management (Billions)

Source: Statista

As Figure 1 illustrates, hedge fund popularity has ballooned recently. A driving factor for this has been a desire among investors to reduce exposure to market volatility. As result, money flowed into hedge funds. However, with almost 4,000 hedge funds in the US, many fund managers have diverged from this traditional framework. The variety of hedge fund strategies available was a key selling point for portfolio managers wanting to diversify. Some notable strategies include long short equity, equity market neutral, derivative trading, and arbitrage trading. Historically, hedge funds’ unifying attribute is their funding structure. Hedge funds source their money from general partners and limited partners. The general partner is the fund manager, and the limited partners are those who invest in the fund. Limited partners are typically institutions and high net worth individuals. Over the last decade, hedging strategies have appeared in other funding structures like mutual funds and exchange traded funds.

LONG SHORT EQUITY

Long short equity is an investing strategy whereby a fund aims to generate returns from both increases and decreases in price. This is achieved through buying stocks the fund deems underpriced and selling short stocks it deems overpriced. This strategy minimizes market exposure and still retains the potential to generate returns. For example, a long short fund may have a gross exposure ratio of 130%. This means that for every dollar an investor contributed to the fund, there is $1.30 working for him.

For example, a fund will invest 100% of investors’ money in stocks. The fund will then sell short shares of various companies until the market value of these shares sold short is equal to 30% of the long book. This produces a net exposure ratio of 70%, meaning 70% of the fund’s portfolio is exposed to market movements. This is because the 30% portfolio hedge, in the form of short sales, reduces market exposure, leaving only 70% susceptible to market movements, all else being equal.

Short selling is when a fund borrows shares from a financial institution and sells them to investors at market price. Ideally, the share price will fall allowing the fund to buy back the shares for a reduced price and return the shares back to the financial institution. The fund profits on the difference between the price it sold the shares for and the price it bought them back for. While the fund waits to buy back the shorted stocks, it holds the cash it received when it sold the borrowed shares.

Consequently, not only is the portfolio positioned to gain from its longs increasing and its shorts decreasing, but also from the interest it earns on its cash. Funds do not need to allocate money to selling short as these are borrowed shares. Selling short does not require investor funds, may reduce volatility, and can potentially provide a cushion during market selloffs.

To learn more about how a long short allocation is well positioned for the current market environment, click here to schedule a call.

15277147-UFD-07/06/2022