Flip on financial TV, and you might come across a segment about the so-called death of value investing. After years of outperformance from high-flying and sexy growth stocks, many pundits proclaim a new paradigm for retail investors to pile into. The old school Warren Buffett-style investing process—once popular with so many mutual fund managers and DIY investors—has been cast aside by a new YOLO approach. It is not dead though. We see a rebirth in this post-Covid world of elevated inflation, rising interest rates, and expensive sexy growth stocks. You could say we have laser eyes on finding value.

Owning shares of companies with reliable free cash flow and positive turnaround stories does not have to be boring. Moreover, we are not growth averse. So long as we find that a company’s intrinsic value is comfortably above the market price of its equity, we will consider owning that business. We are not the “new school” breed of value investors though. We still believe in performing bottoms-up free cash flow analysis and determining the worth of a business based on cash it can deliver to its equity owners.

What Defines Old School Value?

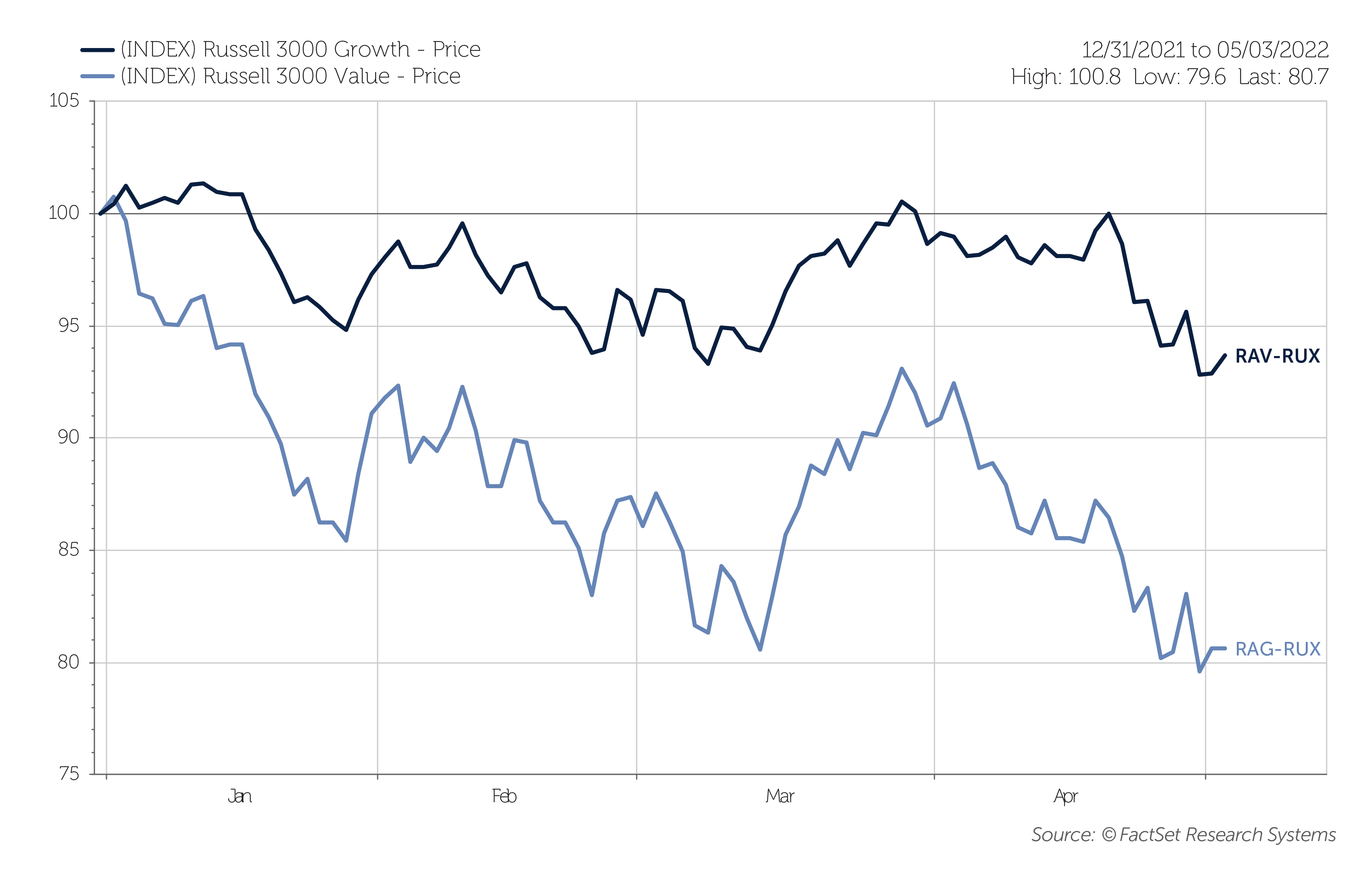

Step back in time a few decades. Warren Buffett, now 91 years old, has amassed a net worth north of $120 billion. He is actually one of the few ultra-billionaires who has seen his net worth climb in 2022—that's a story for another day. The Oracle of Omaha is different from the likes of Elon Musk, Jeff Bezos, and Mark Zuckerberg. Buffett uses time to his advantage—more than 95% of his net worth came after he turned 60 years old. What does that have to do with old school value investing? Well, patience and discipline are vital virtues of the process. We are not looking for a quick buck. We do not believe in buying high and selling higher. We believe recurring cash flows and sound balance sheets are important—such audacity, right? Over the last several years, value stocks have been seen as value traps. That is, many stocks appeared cheap for a reason, and their share prices continued lower as investors piled into a handful of large U.S. growth companies. For a time, classic valuation methods appeared to be broken. The tide changed (like it eventually always does) shortly after Covid. Traditional value sectors came back to life just as “meme stock mania” hit its crescendo in early 2021. Suddenly, the value and profitability factors are leading the market over the last 12 months. The shift has been even more stark since the turn of the year.

Figure 1: Russell 3000 Growth Index vs Russell 3000 Value Index Year-to-Date

How New School Value Adds a Twist

As old school value returns to favor, some portfolio managers shifted their process to new school value methods. Buying businesses in the hopes that they will deliver massive returns five years down the road is not an approach we deem to be rooted in value—that is more of a buy and hope approach in our view. We believe in some thematic ideas, but we are not about to stake sizable amounts of our investors’ capital in a basket of companies that show no imminent signs of producing free cash flow. We are not focused simply on the cash flow statement, though. In fact, the balance sheet is where we look first. So many of today’s supposedly new school value stocks have a capital structure with a high proportion of debt. We see that as a potential risk. When borrowing rates are low and lending standards are easy, sure, debt can lead to bigger profits by way of leverage. That leverage turns problematic when credit markets tighten and economic growth wanes, however. The new school process adds a twist in that it is often more flexible on valuation—buying stocks with EV/EBITDA multiples greater than 20 might be suitable for some, but not for Prospector. While there are some large-cap stocks that might seem like safety plays since they are strong nominal free cash flow generators, the price we pay for those cash flows still matters to us. We like our value businesses straight up.

What We Believe to be True

The old school value style remains at the heart of what we do. We pay relatively less attention to a stock’s P/E ratio, and we do not see ourselves as strict-contrarian investors. Prospector’s value-investing style is not like a religion, but more like flavors of ice cream.

- Free cash flow and private market valuation are our primary methods for finding under-valued securities. Businesses with relatively less leverage and stocks with a margin of safety are ingredients we do not budge on. It’s possible that some of our positions later appear as “GARP” stocks (growth at a reasonable price) since we prefer to let our winners run somewhat, but we do not actively pursue such ideas.

- Another exercise Prospector uses as a risk management tool is to always perform a pre-mortem by asking: What could go wrong with this business and investment? Grasping the max loss potential more than the upside return is a prudent technique we believe leads to better long-term performance.

Conclusion

Prospector’s team of portfolio managers and analysts continues to believe in the old school approach to value investing. We have been around the block a time or two. We’ve seen investing fads go in and out of style. In the end, free cash flow and returning value to shareholders endure. The new school has produced innovative metrics and ratios, such as Total Addressable Market, but those mean relatively little to us. The last year has proved the new school of value investing has its challenges—lessons are being learned. We are encouraged by the recent trend of a focus on positive cash flows in the investing environment. The old school might just be back in session.

14974617-UFD-05102022

Source: Prospector Partners