Current Market Environment

The new year started as we expected: inflation continuing to rise, the Federal Reserve getting increasingly hawkish, interest rates rising, and with a rotation out of growth stocks into value. However, in mid- January, the market’s attention turned to Russia’s building of troops on Ukraine’s border, and ultimately to Vladimir Putin’s and Russia’s invasion - the consequences of which are myriad. Unprecedented sanctions were quickly imposed by much of the world, impacting Russia’s ability to export goods and services and limiting their ability to travel as airspaces across Europe and North America were closed off to Russian aircraft. Many businesses around the globe made independent decisions to cease doing business in and with Russia. The impact of these sanctions worsened the pandemic-induced supply shortage seen in many industries and further fan the flames of inflation.

Brent crude oil, which was rallying as demand from the economy’s “reopening” outpaced growth in supply, spiked 35% in a little over a week on the prospects of Russia’s supply (estimated at 12% of worldwide production) being taken off the market. Wheat rose over 50%, given Ukraine and Russia combined produce almost 30% of worldwide supply. The shortage of automobiles was further exacerbated, as many manufacturers rely on wire harnesses produced in Ukraine. These are examples of the many commodities and products which have been dramatically impacted by the outbreak of war, causing fears of uncontrolled inflation and even stagflation. Against this backdrop, both stocks and bonds sold off during the quarter (although the S&P 500 staged an impressive late-quarter rally, ending the quarter about 10% above the lows hit on the day of the invasion). The benchmark 10-year Treasury ended March at 2.32%, 83 basis points higher than where it stood at year end.

So, what does this all mean for your portfolio? While the Fund has no direct investments in Russia or Ukraine, a handful of investments generate a modest amount of revenues from the region. Given our largely domestic focus, we made only minor changes to the portfolio based on potential impacts from the conflict. However, the far reaching impacts of the war have implications for portfolio positioning. Europe’s economy will likely be hit harder than the U.S., especially given the continent’s reliance on Russian natural gas. Russia is Europe’s largest external source for gas, providing over 30% of their supplies, and any material reduction coming from Russia will have serious implications for Europe’s economy. Thus, our predilection for domestic investments remains in place. Domestically, unemployment levels are below 4%, and the U.S. consumer continues to be in great shape partially as a result of trillions of dollars of pandemic stimulus. However inflationary pressures cannot be ignored. Wages are growing, but costs of goods are growing faster. Odds of a slowdown have increased in our estimation and we have gradually reduced exposure to cyclically-exposed companies, including lowering our large bank bet - much of that via liquidating the First Horizon position (discussed further below) – but also by trimming certain names we deemed as more exposed to credit should the economy turn. Additionally, we have modestly increased exposure to defensive sectors such as healthcare and property-casualty insurers.

Two For The Good Guys!

During the quarter, your portfolio benefited from the announced acquisitions of two holdings: First Horizon Corp. (FHN), and Alleghany Corp. (Y), one of our largest bank positions and largest property- casualty insurance holding respectively. Focusing on FHN first…after a robust year of deal-making in the US bank sector in 2021, the current year is off to a decent start. To date, there have been over 50 M&A deals announced totaling $15 billion in value. Fortunately, your portfolio benefited disproportionately in the first quarter as FHN received an all-cash bid from Toronto-Dominion Bank. The purchase price totaled $13.4 billion, or a +37% purchase price premium.

By way of background, our investment in Tennessee-based First Horizon originated via a holding in IBERIABANK (which was purchased by FHN in early 2020). As the pandemic ensued, we added to the FHN position. In our view, the bank was well-positioned for the COVID environment. Their large mortgage bank and fixed income trading business greatly benefited from the zero-interest rate environment and exhibited counter-cyclical attributes. Also appealing were EPS tailwinds in the form of cost and revenue synergies resulting from First Horizon’s merger with Iberia Bank. Additionally, there was downside protection in the form of a large credit mark on Iberia’s acquired loan book. As the pandemic progressed, First Horizon’s balance sheet became increasingly asset sensitive, resulting in an embedded “call option” on higher rates.

We especially liked the geographic footprint of First Horizon which has a large presence in the attractive markets of Tennessee, the Carolinas, Florida, Georgia, and Texas. We view these markets positively given the presence of pro-business policies and strong in-migration trends fueled by the relative cost of living, job growth, quality of life, and warm weather. Our theory is this should translate into above trend loan growth and be supportive to credit quality in the face of higher rates. As a result, we view the South as an attractive market for M&A, and pegged First Horizon as a long-term M&A candidate. Management teams are confirming our rationale, as the attractiveness of the Southeast is a key reason why Toronto- Dominion is acquiring First Horizon. PNC also cited the attractiveness of the South with their $11.6 billion acquisition of BBVA USA.

While the potential to be acquired is never the sole reason we own a stock, in your portfolio, there are other banks which we view as highly attractive M&A targets. These include Georgia-based Synovus Financial Corp (SNV), Florida-based SouthState Corporation (SSB), and Comerica Incorporated (CMA) which has a large presence in Texas and growing franchises in Florida, Arizona, and North Carolina. We expect the trend of bank consolidation to continue across the United States, with a particular emphasis in the South as supported by the commentary of large potential acquirers. Your portfolio remains in a good position to benefit from this continued trend of consolidation, which is an important catalyst to realizing value.

While our outlook on property-casualty consolidation is less enthusiastic in the near term than banks (insurers are reaping the rewards of years of rate increases, and are more inclined to feel the need to consolidate during a “softer” rate environment), part of our thesis for owning Alleghany was its being undervalued on a sum-of-the-parts / private market value basis, and we’re happy to see that value recognized. We initiated our Alleghany position in May of 2020. The company owns a variety of businesses, but insurance and reinsurance are the largest contributors to aggregate results. Fundamentals for re/insurance started improving in 2019 and we were confident that earnings in 2021-2022 would be much improved. Investor concerns regarding aggregate industry exposure to COVID insurance claims yielded an attractive opportunity in the stock. We knew their businesses well, having followed developments for years, and valued the segments on a sum-of-the-parts analysis, including private market values for comparable re/insurance enterprises sold in recent years. We concluded that shares of Y were selling well below our derived intrinsic value and invested accordingly. On March 21, 2022, Berkshire Hathaway (BRK.A/B) announced an agreement to acquire Alleghany for $848 per share, a 29% premium to Alleghany’s average stock price over the previous 30 days.

It’s worth delving into a recent investment we view similarly to Alleghany - Fairfax Financial (FFH-TSE). Fairfax has been referred to as the “Berkshire of Canada” from time to time. The company owns many sizeable reinsurance and insurance enterprises, as well as a diverse mix of non-insurance businesses, either via 100% ownership, or partial ownership via common stock holdings. We have followed developments at the company for many years and find the current positioning to be quite favorable for the environment of today. On what appears to be the precipice of several Federal Reserve interest rate increases, we note the sizeable cash and short term investment balances of FFH, which equates to ~44% of invested assets and >2x tangible common equity. As we have shared with our thoughts on Alleghany, much value has been created in the re/insurance sector in recent years, and by our estimation, the current share price of FFH does not accurately reflect the private market values of its insurance subsidiaries. Interestingly, in December of 2021, FFH sold 10% of one of its subsidiaries, Odyssey Re, for $900M, implying a $9 billion valuation for that subsidiary. For point of reference, Odyssey accounts for less than half of FFH’s tangible equity, and the aggregate market capitalization of FFH is $13 billion. With a view that FFH is significantly undervalued, we initiated a position in FFH during the first quarter.

Outlook

2022 is setting up to be what we believe will be a pivotal year. In our opinion, much will depend on how successful the Federal Reserve is at transitioning from an ultra-stimulative posture, to a less accommodative one (the elusive soft landing), while the U.S. and rest of the world is dealing with the impacts of Russia’s invasion of Ukraine. At this point it appears that the U.S. consumer remains resilient, with healthy balance sheets following trillions in fiscal stimulus. The impacts from the COVID-19 pandemic are waning and immunity from prior infections, increasing vaccinations, and release of anti-virals should help further the reopening of our economy.

Interest and mortgage rates have lifted off historically low levels, with 30-year mortgage rates recently topping 5% - potentially a psychologically important level. We are seeing reinflation in many areas of the economy, and are watching this closely given the historically high levels of government spending here and around the world. Unemployment has shown significant improvement, but labor continues to be an issue as the participation rate continues to be low and labor shortages are impacting many industries.

In our estimation, overall equity valuations remain at elevated levels. Treasury and high-grade corporate bond yields look unattractive. In any case, we believe that value investing is ripe for a period of outperformance, and the bargains inherent in your portfolio should attract acquirers and other investors over time. Meanwhile, we still believe equities represent a superior asset allocation alternative to bonds over the longer term.

Steadfast, we remain committed to helping you meet your financial goals while aiming to help preserve your wealth.

Portfolio Overview

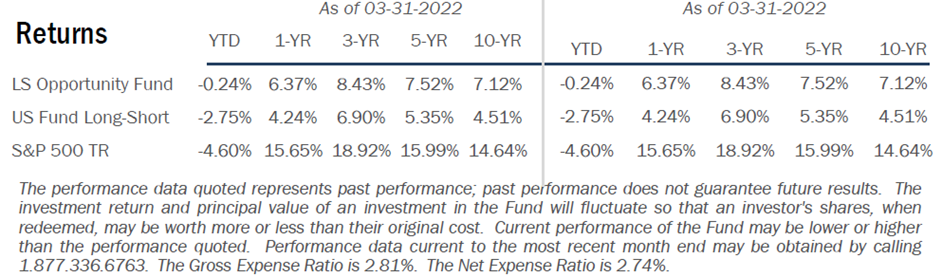

Disclosures:

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus by calling 1.877.336.6763.

Past performance is not a guarantee of future results.

Important Risk Information

Investment in shares of a long/short equity fund have the potential for significant risk and volatility. A short equity strategy can diminish returns in a rising market as well as having the potential for unlimited losses. These types of funds typically have a high portfolio turnover that could increase transaction costs and cause short-term capital gains to be realized. The stocks in the Fund’s portfolio may decline in value or not increase in value when the stock market in general is increasing or decreasing in value and you could lose money. The Fund may lose money due to fluctuations within the stock market which may be unrelated to individual issuers and could not have been predicted. The price of the securities which the Fund holds may change unpredictably and due to local, regional, international, or global events. In the case of a general market downturn, multiple asset classes, or the entire market, may be negatively affected for an extended and unknown amount of time.

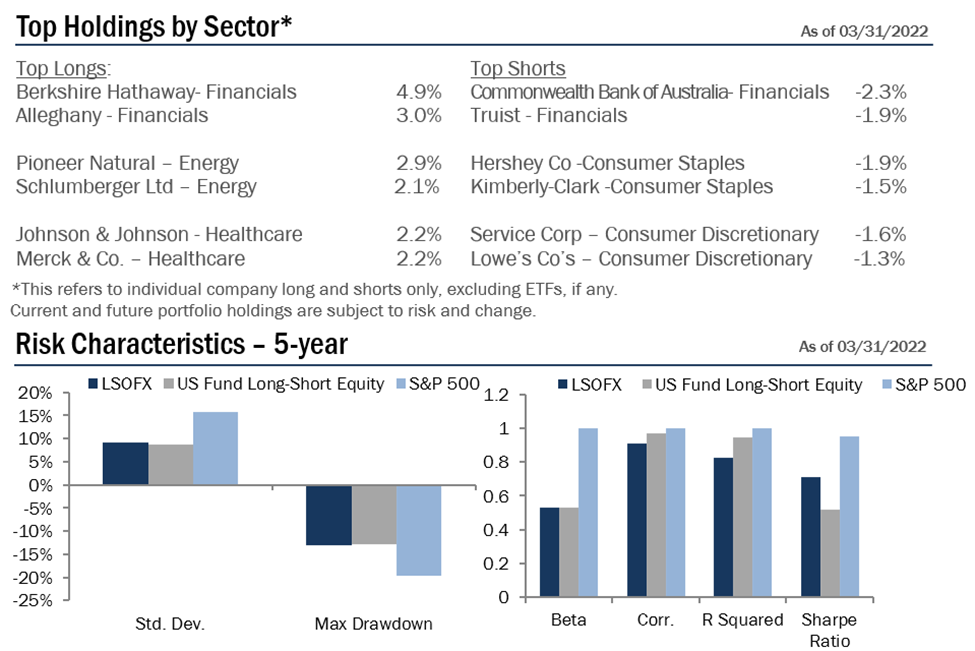

Risk Statistic Definitions:

Standard Deviation measures the volatility of the Fund’s returns. Beta measures the Fund’s sensitivity to market movements. Sharpe Ratio uses the Fund’s standard deviation and average excess return over the risk-free rate to determine reward per unit of risk. R-squared represents the percentage of the portfolio’s movements that can be explained by general market movements. Upside/Downside Capture Ratio measures a manager’s ability to generate an excess return above the benchmark return in up markets and retain more of the excess return in down markets. Risk statistics are relative to the S&P 500. Batting Average is a statistical measure used to evaluate an investment manager’s ability to meet or beat their index. Omega is a relative measure of the likelihood of achieving a given return. Max Drawdown is the peak-to-trough decline during a specific recorded period of an investment. Gross Exposure is the sum of the absolute values of the fund’s long and short exposures. Net Exposure is the fund’s total long exposure less the fund’s total short exposure. The Expense Ratio, Gross of Any Fee Waivers or Expense Reimbursements, is 2.81%. The Expense Ratio, Net of Fee Waivers and Expense Reimbursements (contractual through 9/30/2022), is 2.74%. The Expense Cap is 1.95. The Adviser has contractually agreed to waive or limit its fees to 1.95% and to assume other expenses of the Fund until September 30, 2022, so that the ratio of total annual operating expenses (not including interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of business, dividend expenses on short sales, expenses incurred under a Rule 12b-1 plan, acquired fund fees and expenses and expenses that the Fund incurred but did not actually pay because of an expense offset arrangement) does not exceed 1.95%.

Prospector Partners, LLC assumed investment management duties on 05-28-2015 and was formally approved by shareholders on 09-17-2015.

Morningstar US Long Short Fund Category – Long-short portfolios hold sizable stakes in both long and short positions. Some funds that fall into this category are market neutral – dividing their exposure equally between long and short positions in an attempt to earn a modest return that is not tied to the market’s fortunes. Other positions that are not market neutral will shift their exposure to long and short positions depending upon their macro outlook or the opportunities they uncover through bottom-up research.

†† The Morningstar Rating for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance The top 10% of products in each product category received 5 stars, the next 22 5% receive 4 stars, the next 35% receive 3 stars, the next 22 5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. Across the US Long Short Equity category, as of 03/31/2022, LSOFX received the following Morningstar Rating™ for the 3-year, 5-year, 10-year periods, respectively: 3 stars out of 178 funds, 4 stars out of 154 funds, and 4 stars out of 58 funds.

The Fund is distributed by Ultimus Fund Distributors, LLC. (Member FINRA).

14848082-UFD-04182022