A Grim Start for Equities

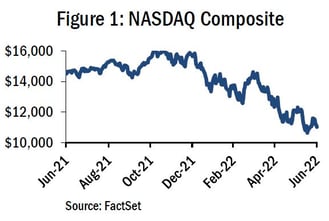

Equity markets have been battered thus far in 2022. Since the Fed signaled a more hawkish tone on fighting inflation, investors have soured on stocks, especially shares of tech companies. These high-flying growth stocks have enjoyed heightened investor enthusiasm for the past decade, with their performance accelerating during the Pandemic. However, after the Fed signaled a shift in its policy stance, investors have begun to sour on these stocks with lofty equity valuations. The Nasdaq is well into bear territory and money managers have indicated it is not clear if the index has bottomed yet.

Figure 1 shows the S&P 500 has been trending downward since the beginning of this year. Rising rate environments typically coincide with a decline in equity valuations because investors are willing to pay less for future earnings, thereby reducing stock prices. Traditionally, investors turn to bonds during periods of equity declines, but that has not proved overly helpful in 2022 as many bonds have sold off in tandem with equities.

Bonds for safety, wait, not so fast

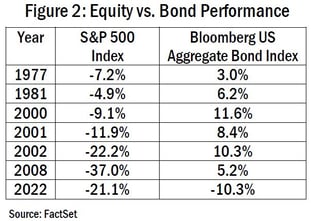

Historically, stocks and bonds have had an inverse relationship as shown in Figure 2. Bonds are often seen as a safe haven compared to stocks because they are thought to carry a lot less risk than equities and have a more certain return. Historically, when equity prices fell, bond prices rose. So far in 2022, this is not the case. With the prospect of rising rates to combat inflation, investors have been selling bonds as well as stocks, sending both asset classes down at the same time. In this environment of rising yields, bonds are flawed precisely because of their inverse relationship to rising bond yields which forces bond prices lower and creates the exact portfolio volatility that bond allocations are supposed to mitigate.

Historically, stocks and bonds have had an inverse relationship as shown in Figure 2. Bonds are often seen as a safe haven compared to stocks because they are thought to carry a lot less risk than equities and have a more certain return. Historically, when equity prices fell, bond prices rose. So far in 2022, this is not the case. With the prospect of rising rates to combat inflation, investors have been selling bonds as well as stocks, sending both asset classes down at the same time. In this environment of rising yields, bonds are flawed precisely because of their inverse relationship to rising bond yields which forces bond prices lower and creates the exact portfolio volatility that bond allocations are supposed to mitigate.

While anyone’s guess, the consensus is that the rising rate environment could continue into at least 2024, meaning a shift in investor sentiment regarding bonds as a safe haven, may not be imminent. The Fed has signaled it is willing to risk putting the US economy in a recession in order to combat inflation. This conveys the Fed’s resolve to raise rates above their historic lows.

Additionally, the Fed Board of Governors has revealed it will begin shrinking its $8.9 trillion bond portfolio, taking billions of dollars of liquidity out of the credit market per month, and potentially further raising rates. Additionally with inflation above 8%, the future yield of bonds will be less rewarding in real dollars. The ability to mitigate equity volatility with a bond portfolio is no longer the foregone conclusion it was once considered as he bond outlook remains gloomy.

So what is an investor to do…

With traditional investment strategies failing to mitigate volatility, investors would be wise to look elsewhere to reduce downside risk. For example, a long short investment strategy is positioned to achieve capital growth during periods of rising or stable stock prices and capital preservation during periods of declining stock prices. As we traverse what could be a period of sustained equity and bond volatility, using a long short strategy may be the key to stability in our unstable world.

15277147-UFD-07/06/2022