Sky-High Inflation

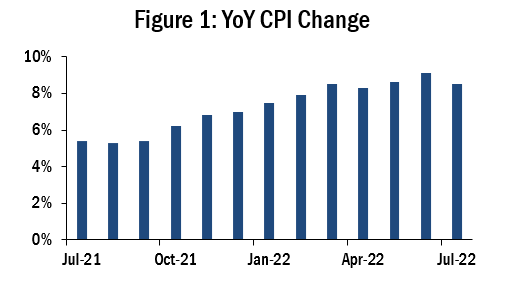

As business closures and shelter in place orders were removed, pent up demand was released. We first began to see the economic ramifications of this in April 2021, when year-over-year (YoY) percent change in Consumer Price Index* (CPI) jumped to 4.2% from 2.6% in the prior month, according to the Bureau of Labor Statistics. CPI figures in July 2022 were 8.5% higher than July 2021.

Source: Bureau of Labor Statistics

As Figure 1 illustrates, change in CPI has been trending up for the past year. While the headline figure for July was lower than that of June, it was mostly driven down by declining energy prices. The change in core CPI, excluding energy and food, increased 0.3% from June to July, signaling inflation may be more ingrained into the economy than the headline figure suggests. There are several factors contributing to the mismatch between supply and demand and the subsequent rise in prices. First, American consumers received several thousand dollars in stimulus checks, which meant more money chasing too few goods, causing prices to rise. Producers could not keep up with this increase in demand because of COVID-19-related supply chain issues. These included forced factory closures to contain COVID-19, worker shortages, parts shortages, logistics issues, and higher producer prices. Factory output is still struggling to keep up because modern supply chains are very complex and interdependent. Adding to these inflationary pressures are soaring commodity prices. For example, Brent Crude Oil is up 45% over the last year. This is due to crimped supply and geopolitical events unfolding on the global scale. Because oil and refined oil products play a major role in the supply chain, rising oil costs have a large impact on inflation figures.

What this Means for Equities

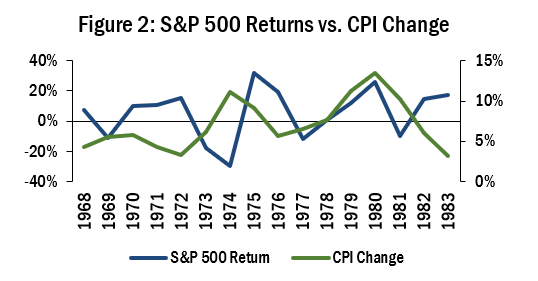

High inflation is typically viewed as a negative economic signal by investors because it is traditionally followed by fiscal and monetary tightening. This in turn usually slows economic activity, reducing corporate earnings. Inflation clouds the economic outlook, and this uncertainty weighs on markets as we have seen since the beginning of 2022. Valuing companies during inflationary periods becomes especially challenging as investors are uncertain over how valuable companies’ future earnings will be in real dollars.

Source: Macrotrends and Bureau of Labor

Figure 2 reveals that during previous inflationary periods, equity markets were very volatile. During this period, S&P 500 returns and CPI change tended to move inversely to one another. This volatility could potentially return if inflation does not return to normal levels.

“Only when the tide goes out do you discover who's been swimming naked” – Warren Buffet

As the rising tide of cheap debt and endless borrowing lifted all boats, it also lifted the fortunes of even the most marginal companies. But as the receding tide of tightening monetary policy and inflation reveals which companies are struggling to meet investor expectations, winners and losers may emerge. A long short strategy which seeks to invest in the winners and bet against the losers has the potential to combat the economic challenges ahead of us. Some companies will thrive, other will not. With long short investing, you can ignore the tide because you are standing on a floating dock. To learn more about Long Short Advisors and what we offer, click here.

*The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S.

consumers. The U.S. Bureau of Labor Statistics (BLS) calculates the CPI as a weighted

average of prices for a basket of goods and services representative of aggregate U.S.

consumer spending.

15280562-UFD-07/07/2022