High-Yield Bonds

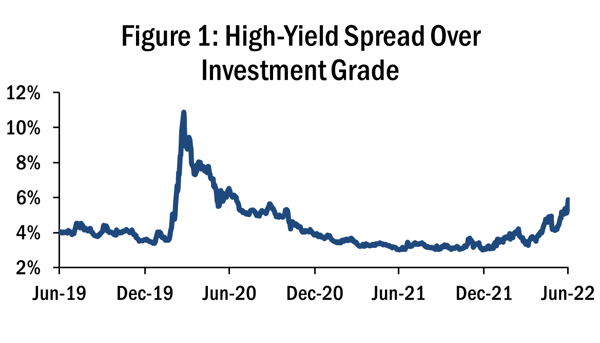

High-yield bonds, as the name suggests, are bonds that pay a higher yield to their investors to compensate for the additional risk compared to investment grade and treasuries. High-yield bonds are also called junk bonds. Issuers of junk bonds are typically companies that are in a poor financial standing or have failed to pay back debt in the past. Actions like these can lower a company’s credit rating below investment-grade. The lower the credit rating of the issuing company, the higher the yield it must offer on its debt to attract investors. Companies with poor credit quality pay out more interest to investors to compensate for the higher risk of default. High-yield bonds are suffering significant losses in 2022. As of June 30, the Fed recorded high yield bonds are offering a 5.8% premium over investment grade bonds. However, a significant headwind facing high yield bonds is rising interest rates which are pushing down the price of existing bonds and raising the future borrowing costs of companies. Since the beginning of the year, the Fed boosted interest rates by 1.5%, with further increases expected.

High-Yield Bonds are Facing a Double Whammy

Source: Federal Reserve

Source: Federal Reserve

With cheap prices, higher yields, and a clearer picture on interest rate hikes, high-yield debt could make a strong investment, right? What is not to like about scooping up bonds at a bargain, enjoying a yield over 8%, and riding the price back up? For starters, no one can be certain about the pace and scale of the Fed’s interest rate policy. Prior to its June meeting, it signaled a rate increase of 50 bps, but ultimately opted for a 75 bp hike, throwing the bond market for a loop! If this were to occur in the future again, there is no telling how far bond prices could potentially fall as investors could see the Fed as less credible in its policy plans.

Figure 1 shows the spread between junk and investment grade bonds. The recent increase is partly due to investor pessimism over speculative grade borrowers’ ability to pay back debt due to the deteriorating credit environment. Investors are demanding high yields to compensate for the risk of default. A similar trend occurred at the beginning of the pandemic when investors had no clear indication of whether companies would be able to repay their debt as the economy shut down. Our economic environment provides significant headwinds for companies already struggling to pay off high interest debt.

As we have mentioned in previous articles, we could be entering the end of a credit cycle , similar to ’08. This can be characterized as higher interest rates, leading to higher interest expenses, lower profits, and eventual default for some companies. Given the potential for this in the future, investors should think twice about loaning money to the most indebted and struggling companies in the market. S&P Global estimates that by March ’23, the default rate on speculative grade debt could reach 3%, more than doubling from March ’22 when the default rate was 1.4%.

Do you want to press your luck with high-yield bonds?

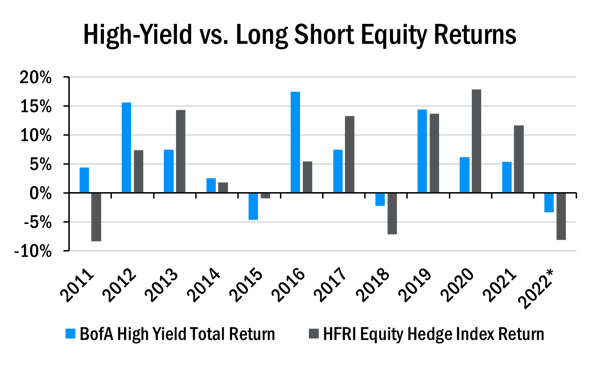

*As of 05/31/2022

*As of 05/31/2022

We have been very vocal about how a long short allocation can deliver returns, even when the broader market cannot. Given the backdrop of easy money and low rates, long short and high-yield returns were similar for the last decade and neither one had clear signs of being the better investment. However, as we adjust to a rising rate and capital constrained environment, investors can potentially achieve the historical risk adjusted returns of high-yield bonds, through long short without the risks associated with high-yield bonds. Steep rate increases, the potential end of a credit cycle, and falling corporate earnings are all posing headwinds for high-yield bonds. Investors would be smarter to avoid these risks and turn to an investment that has historically been less volatile and more consistent.

Long short managers like capital constrained environments and volatility because it reveals which companies are doing well and which are not. This is exactly what long short investing aims to capitalize on. Thus, with volatility, long short strategies can potentially generate strong returns for investors, whereas highly indebted companies face the prospect of bankruptcy at the worst and increased interest expense and decreased margins at the best. In economic times like these, rather than betting on heavily indebted companies by buying their junk bonds, wouldn’t it make more sense to bet against them? Lucky for investors, they can do just that with long short!

15310261-UFD-07122022